European equities edged lower on Tuesday, pressured by declines in automobile and telecom stocks, as escalating trade tensions between the United States and China unsettled investors. The pan-European STOXX 600 index declined 0.3% in early trading, extending losses from Monday when the benchmark posted its largest single-day drop in over …

Read More »European Markets Drop as Trump Tariffs Spark Global Selloff

European stocks retreated sharply on Monday, mirroring a global selloff as investors feared an escalating trade war after U.S. President Donald Trump imposed new tariffs on China, Canada, and Mexico. Market Reaction: STOXX 600 index fell 1.4% by 0810 GMT S&P 500 futures dropped 1.3%, signaling a weak Wall Street …

Read More »European Stocks Edge Higher as ECB Rate Cut Boosts Sentiment

European stock markets rose slightly on Friday, supported by the European Central Bank’s (ECB) interest rate cut, while investors assessed corporate earnings and inflation data across the region. Germany’s DAX gained 0.1%. France’s CAC 40 rose 0.2%. UK’s FTSE 100 climbed 0.2%. Key Market Drivers 1. ECB Rate Cut Fuels …

Read More »European Stocks Gain as Investors Await ECB Decision and Growth Data

European stock markets advanced on Thursday, as investors evaluated a wave of corporate earnings while anticipating the European Central Bank’s (ECB) policy decision and eurozone growth data. DAX (Germany): +0.2% CAC 40 (France): +0.3% FTSE 100 (UK): +0.1% Key Market Drivers 1. ECB Policy Decision in Focus European equities received …

Read More »Euro tends to fall, eyes on ECB 30/1/2025

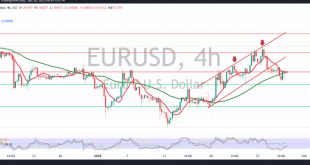

The EUR/USD pair remained within a narrow sideways range in the previous session, trading above 1.0380 and below 1.0450 without significant movement. Technical Outlook: The pair remains below the key resistance levels of 1.0460 and 1.0485. The Stochastic indicator is positioned near overbought levels, suggesting potential downside pressure. Key Levels …

Read More »European Markets Steady as Investors Digest Corporate Earnings, Await ECB and Fed Decisions

European stock markets remained relatively stable on Wednesday as investors evaluated a series of major corporate earnings while awaiting policy decisions from both the European Central Bank (ECB) and the U.S. Federal Reserve. As of 03:05 ET (08:05 GMT): Germany’s DAX rose 0.4% France’s CAC 40 slipped 0.4% UK’s FTSE …

Read More »Euro may continue gradual decline 29/1/2025

The EUR/USD pair remains in narrow sideways trading, gradually declining toward the first target of 1.0400, after recording its lowest price at 1.0414. From a technical analysis perspective, the 4-hour chart shows the pair stabilizing below the key resistance levels of 1.0460 and, more importantly, 1.0485. Additionally, the 14-day momentum …

Read More »Euro faces negative pressure 28/1/2025

The euro declined against the US dollar during the morning trading session today, retreating after several consecutive sessions of gains and failing to maintain its position above the psychological barrier of 1.0500. From a technical perspective, a closer examination of the 4-hour chart reveals that the pair is holding below …

Read More »European Shares Drop as China’s AI Innovation Sparks Tech Selloff

European shares faced significant losses on Monday, driven by a selloff in the technology sector after China’s DeepSeek unveiled a low-cost, energy-efficient AI model. The development raised concerns over the profitability of existing AI players and reduced demand for high-performance chips. Market Highlights: STOXX 600: Fell 0.6% by 0941 GMT, …

Read More »Davos Highlights: Business Leaders and Trump Push EU for Faster Deregulation

At the World Economic Forum in Davos, global business leaders echoed U.S. President Donald Trump’s calls for the European Union to expedite deregulation and enhance competition. The discussions underscored growing concerns about the EU’s ability to keep pace with other developed markets, particularly in light of rapid advancements in technology …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations