Shares of major Italian utility companies fell sharply on Thursday after the government approved an increase in corporate taxation targeting the energy sector, raising concerns over profitability and regulatory risk. By 09:11 GMT, shares in A2A (BIT: A2) were down 3.5%, while Enel (BIT: ENEI) slipped 3.1%. Hera (BIT: HRA) …

Read More »Weekly Market Wrap: Investors are betting on further Fed rate cut

Financial markets ended last week in a state of uncertainty following the release of what were arguably the most consequential U.S. data sets for global trading: employment figures and inflation readings. These developments are the focus of this week’s market summary. U.S. labor‑market data reflected a continued deterioration over the …

Read More »Italy’s Industrial Production Drops 1% in October, Underscoring Ongoing Manufacturing Weakness

Italy’s industrial output fell sharply in October, highlighting renewed pressure on the country’s manufacturing sector after a brief rebound in September. Data released Wednesday showed industrial production declined 1.0% month-on-month, far worse than expectations for a 0.3% drop in a Reuters poll of analysts. The setback followed a 2.7% rise …

Read More »Weekly market wrap: The U.S. Dollar Suffers Heavy Losses amid anticipation of Fed’s Decision

The US dollar ended last week lower, pressured by a mix of economic data and political developments. Among the key drivers were weaker macroeconomic indicators, comments from President Donald Trump, and reports about potential successors to Federal Reserve Chair Jerome Powell. Together, these factors reinforced expectations of a rate cut …

Read More »Euro Weakens Against the Dollar Despite Upgraded Growth Outlook

The euro slipped against the U.S. dollar today, with EUR/USD down 0.30%, as the greenback strengthened and cautious remarks from the European Central Bank weighed on sentiment. ECB Vice President Luis de Guindos warned that financial stability risks in the Eurozone “remain elevated,” citing uncertainty over global economic trends and …

Read More »Weekly market recap: Markets React to U.S.–China Trade and Fed Policy Shifts

The U.S. dollar posted weekly gains, supported by hawkish Federal Reserve commentary and improving trade relations between Washington and Beijing. The dollar index, which measures the greenback against a basket of major currencies, rose 0.4% to a three-week high at the start of last week and ended the week up …

Read More »Is Europe’s Political Unrest the Real Test of the Euro’s Resilience?

The Euro has found a momentary calm after days of turbulence, but the question lingering over global markets is far from settled: can Europe’s political institutions contain the fallout before confidence erodes further? The recent standoff in France, coupled with Washington’s prolonged government shutdown, has thrust the EUR/USD exchange rate …

Read More »Italy’s Unemployment Rate Rises to 6.0% in August, Youth Joblessness Climbs Sharply

Italy’s unemployment rate edged higher in August, with official data showing signs of weakness in the labor market despite analysts having expected a slight uptick. Figures from national statistics bureau ISTAT released Thursday showed the seasonally adjusted jobless rate rose to 6.0%, up from a downwardly revised 5.9% in July. …

Read More »Italy’s Manufacturing Sector Slips Back into Contraction in September

Italy’s manufacturing activity contracted in September, reversing August’s modest growth, as both production and new orders declined amid economic uncertainty, survey data showed on Wednesday. The HCOB Italy Manufacturing PMI dropped to 49.0 in September from 50.4 in August, marking the sharpest deterioration in three months. A reading below the …

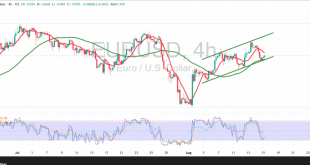

Read More »Euro Attempts to Regain Upward Momentum 15/8/2025

The EUR/USD pair retreated in the previous trading session after two unsuccessful attempts to close above the key psychological resistance at 1.1700. Technical Outlook – 4-hour timeframe: Despite the pullback, technical indicators remain supportive of a potential rebound, as the price continues to trade above the 50-period simple moving average. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations