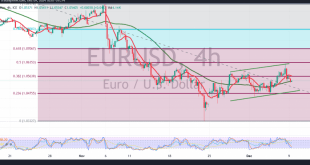

The EUR/USD pair ended last week’s trading on a bullish note, surpassing the 1.0560 resistance level and reaching the target of 1.0635, marking its highest level at 1.0635. Technical Analysis: Momentum Indicators: The 240-minute chart shows support from the 50-day simple moving average, alongside the Stochastic indicator signaling positive momentum, …

Read More »Euro loses momentum 5/12/2024

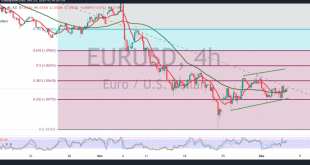

The EUR/USD pair showed a modest upward trend, benefiting from the support level of 1.0470, and reached a session high of 1.0544 during the previous trading day. Technical Analysis: The pair struggled to break the critical resistance at 1.0540, as noted in the previous analysis. On the 4-hour chart, the …

Read More »Euro is looking for a movement signal 4/12/2024

Narrow sideways trading dominates the movements of the euro against the US dollar, confined from below above 1.0480 and from above without resistance 1.0510. On the technical side today, and with a closer look at the 4-hour chart, we find that the simple moving averages still support the possibility of …

Read More »Euro tries to recover 25/11/2024

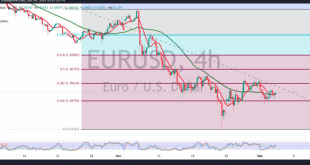

The EUR/USD pair attempted a recovery after several sessions of decline, hitting a low of 1.0330 before opening today’s trading with an upward gap. Technical Outlook: Indicators: The 4-hour chart reveals negative crossover signals from the Stochastic indicator, now in the overbought zone, coupled with continued downward pressure from the …

Read More »Euro retests resistance 19/11/2024

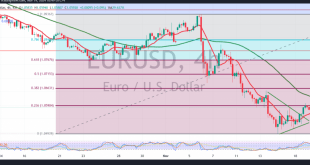

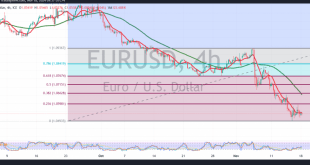

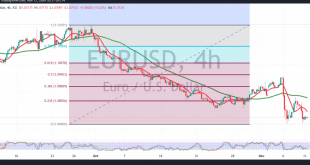

The Euro made some gains against the US Dollar during the previous trading session, attempting to retest the psychological barrier resistance level at 1.0600. From a technical standpoint, the pair is currently hovering around this resistance, which aligns with the 23.60% Fibonacci correction on the 4-hour chart. The Stochastic indicator …

Read More »Euro expected to fall further 18/11/2024

The US dollar continues to exert downward pressure on the euro, hitting the first official target highlighted in the previous technical report at 1.0510, with a recorded low of 1.0515. From a technical standpoint, and based on a closer analysis of the 4-hour chart, the pair remains stable below the …

Read More »Euro expected to decline further 14/11/2024

The Euro remains firmly in a downtrend against the US Dollar, as we had anticipated, reaching our previous target of 1.0565 and even dipping to a low of 1.0545 during the morning trading session. On the technical front, the 4-hour chart indicates persistent negative pressure from the simple moving averages, …

Read More »Euro continues to fall against dollar 13/11/2024

The Euro continues to decline, pressured by the strengthening US dollar. The pair reached the initial target outlined in our previous report at 1.0600, with the lowest recorded level at 1.0595. From a technical perspective, examining the 240-minute chart reveals persistent negative pressure from the simple moving averages, which act …

Read More »Euro continues to fall against dollar 12/11/2024

The Euro experienced a significant decline against the U.S. Dollar, in line with previous expectations, after successfully breaking the 1.0680 support level. This move took the pair down to its initial target at 1.0665, coming close to the next key station at 1.0610, with a recorded low of 1.0628. Technical …

Read More »Euro awaits confirmation of break 11/11/2024

The EUR/USD pair continues to experience bearish pressure, reaching a low of 1.0667 at the end of last week’s trading session. Technical Analysis: Bearish Outlook: The simple moving averages exert downward pressure on the pair, and trading remains below the significant resistance level at 1.0785. Support Levels: A decisive break …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations