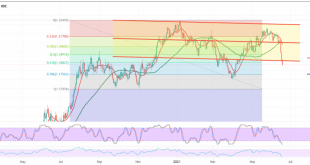

The Euro hit the published pivotal resistance level that is required to be retested during the previous analysis at 1.1970, which still constitutes an obstacle for the pair, unable to breach it until now. Technically, we are inclined towards negativity in our trading, based on the negative pressure coming from …

Read More »Euro: Pressing Support And Looking For New Signal

Trades tended to the positive within the context of the retest that is required to be achieved on short intervals at 1.1975 so that the euro was satisfied with recording its highest level at 1.1952. Technically, and by looking at the chart, the 50-day moving average is still pressuring the …

Read More »Euro: Trying to Recover And Positivity Still Limited

Positive attempts by the euro against the US dollar, but still limited positivity, within the euro’s attempts to restore the bullish path temporarily, benefiting from the consolidation at the 1.1880 support level. Technically, and by looking at the 60-minute chart, we find the 50-day moving average trying to push the …

Read More »EUR/USD Recovers and Restores 1.1920 Level

The Euro (EUR) rose against the U.S. Dollar (USD) on Monday after falling for three consecutive sessions. Profit-making and uncertainty about the infrastructure spending plan are weighing on the USD, with markets still digesting the change in tone by the U.S. Federal Reserve. The EUR/USD pair gained 0.47% and reached …

Read More »Euro: Negative Pressure Remains

The bearish wave is still dominating the euro against the US dollar after slight positive movements through which the pair returned the previously broken support level 1.1880/1.1890. Technically, the bearish trend is still a valid and effective scenario, as a result of the pair continuing to obtain negative pressure coming …

Read More »The Euro Extends Its Losses Against The US Dollar

The European single currency declined noticeably against the US dollar for two consecutive sessions, reaching as low as 1.1890. On the technical side, and with a closer look at the 4-hour chart, we find the current moves are showing some bullish bias but still limited. The simple moving averages continue …

Read More »EUR/USD Logs Biggest Daily Loss in 15 Months

The Euro (EUR) declined against the U.S. Dollar (USD) on Wednesday, following the U.S. Federal Reserve’s policy meeting, in which the central bank decided to maintain its current policy, expecting rising inflation and seeing two rate hikes in 2023. Today, the EUR/USD pair lost about 1.08%, falling below 1.2 and …

Read More »Euro Settled Below Support And May Experience a Gradual Decline

The technical outlook is unchanged, and the pair’s movements did not change for the second consecutive session, amid quiet trading that dominated the movements of the single European currency against the US dollar. The current movements are witnessing attempts to recover, but still limited. Technically, and with a closer look …

Read More »Euro is Stable Below Support And Attempts to Recover Are Limited

Quiet trading dominated the movements of the single European currency against the US dollar during the previous session so that the current movements witnessed attempts to recover, but there are still limited attempts. Technically, and with a closer look at the 60-minute chart, we find that the RSI is trying …

Read More »Euro Breaks Support And Negativity Remains

The euro declined against the US dollar noticeably at the end of last week’s trading within the expected bearish context, in which we relied on confirming breaking 1.2170, and then 1.2145, heading to touch the first target published during the previous analysis at 1.2110, recording the lowest level at 1.2090. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations