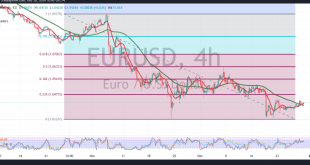

The euro declined against the US dollar during the morning trading session today, retreating after several consecutive sessions of gains and failing to maintain its position above the psychological barrier of 1.0500. From a technical perspective, a closer examination of the 4-hour chart reveals that the pair is holding below …

Read More »Euro touches official target 3/1/2025

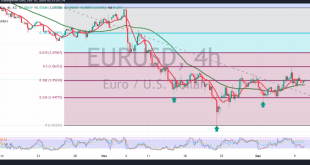

As anticipated in the previous report, the EUR/USD pair extended its strong downtrend, achieving the target of 1.0250 and marking a low of 1.0220. Technical Outlook:A closer look at the 4-hour chart highlights continued bearish pressure from the 50-day simple moving average. However, the Stochastic indicator is beginning to show …

Read More »Euro tries with limited positivity 2/1/2025

The EUR/USD pair concluded last year’s trading with predominantly negative performance, aligning with the bearish scenario outlined in the previous technical report. The pair came within a few points of the anticipated target at 1.0330, reaching a low of 1.0340. Technical Overview:In today’s session, the pair attempted a limited upward …

Read More »Euro holds steady below resistance 30/12/2024

The EUR/USD pair continues to trade under a dominant downtrend, consistent with the bearish outlook mentioned in the previous report. Current price movements remain stable below the key resistance level at 1.0475. Technical Analysis:The 50-day simple moving average continues to exert downward pressure, reinforced by the Stochastic indicator’s clear negative …

Read More »Euro on sideways track 18/12/2024

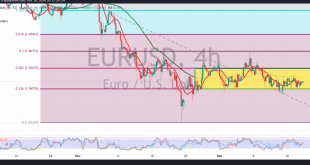

The EUR/USD pair continues to exhibit narrow sideways trading, confined between support at 1.0470 and resistance at 1.0560. From a technical standpoint, the pair remains under pressure below the 50-day simple moving average, reinforcing the likelihood of a bearish continuation. This is further supported by the negative signals from the …

Read More »Euro awaits negative stimulus 16/12/2024

The EUR/USD pair experienced negative trading towards the end of last week’s sessions, exerting pressure on the support level of 1.0470 and recording a low of 1.0453. Technically, the pair is showing attempts at a bullish bounce due to its temporary stability above the strong support at 1.0470. However, the …

Read More »Euro faces negative pressure ahead of ECB 12/12/2024

The Euro continued its retreat against the US Dollar during the previous session, aligning with the anticipated negative outlook, reaching the first target of 1.0475 and recording a low of 1.0479. Technical Analysis An analysis of the 240-minute chart indicates: Bearish Factors: The simple moving averages are exerting downward pressure. …

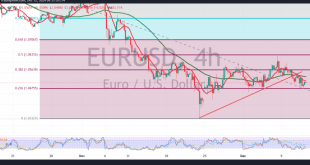

Read More »Euro hits resistance 11/12/2024

The EUR/USD pair encountered strong resistance around 1.0660, forcing it to retreat under negative pressures, marking its lowest level during the previous session at 1.0498. Technically, the 240-minute chart reveals the return of simple moving averages exerting downward pressure on the price, coupled with bearish signals from the Stochastic indicator. …

Read More »EUR/USD Weakens on ECB Dovish Bets, US Inflation in Focus

EUR/USD pair declined to near 1.0520 on Tuesday as investors braced for key economic events, including the US inflation report and the ECB monetary policy meeting.ECB Expected to Cut RatesThe ECB is widely anticipated to reduce its Deposit Facility Rate by 25 basis points to 3% on Thursday. This would …

Read More »Euro trying to recover 10/12/2024

The EUR/USD pair maintained its upward trajectory within the anticipated positive outlook highlighted in the previous technical report, reaching the first target of 1.0600 and recording a high of 1.0597. Technically, today’s analysis of the 4-hour chart shows the 50-day simple moving average supporting the bullish movement, alongside positive momentum …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations