We adhered to intraday neutrality during the previous analysis due to the conflicting technical signals, in addition to the limited trading between the daily trend keys published yesterday, explaining that activating the short positions as soon as 1.0150 is broken, targeting 1.0120, to record the pair’s lowest level at 1.0118. …

Read More »Euro awaits pending orders 3/8/2022

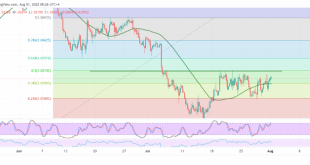

Mixed trading dominated the movements of the euro-dollar, heading to approach the first official station targeted during the previous report 1.0300, to settle for recording the highest level at 1.0293, which formed a strong resistance level around the psychological barrier that forced the pair to the downside to retest the …

Read More »Euro looking for more momentum 2/8/2022

Quiet trading tilted to the positive, dominating the euro’s movements against the US dollar within the expected bullish path during the previous report, touching the first awaited target at 1.0275, recording the highest level at 1.0293. On the technical side, today, we find the bullish scenario still valid, relying on …

Read More »Euro is looking for more bullish momentum 1/8/2022

The euro showed upward movements against the US dollar, which continued its descending correction to its lowest level in 3 weeks to record the highest level last Friday at 1.0254. Today’s technical vision indicates the possibility of continuing the bullish bias due to the positive motive coming from the 50-day …

Read More »Euro breaks pivotal levels 6/7/2022

EURUSD incurred noticeable losses during the last trading session, within the expected bearish technical outlook in the previous analysis, explaining that the official target of the current downside wave is its target at 1.0285, recording its lowest level at 1.0235. Technically and carefully considering the 4-hour chart, we notice the …

Read More »Euro touches goal 1/7/2022

Bearish movements dominated the euro against the US dollar within the expected negative outlook during the previous analysis, touching the first target of 1.0400 and approaching by a few points the second target of 1.0375, recording its lowest level at 1.0382. On the technical side, the trading witnessed a little …

Read More »The euro fails to maintain its gains 30/6/2022

The euro failed to maintain its recent gains against the US dollar after its inability to stabilize above the resistance level of 1.0500, which forced it to break the psychological support level of 1.0500. It is currently trading around the support level of 1.0460. Technically, and with careful consideration of …

Read More »The euro is trying to recover 28/6/2022

The single European currency continues to recover against the US dollar within the expected bullish path, approaching the first price target of 1.0630, to record its highest level during the last session’s trading of 1.0613. Technically, by looking at the 4-hour chart, we find the current intraday movements of the …

Read More »Euro touches the required goals 23/6/2022

The strong support level published during the previous analysis at 1.0470 pushed the price to the upside, as we expected, for the euro to reach the required targets at 1.0550 and 1.0580, recording the highest around the psychological edge of 1.0605. Technically, we find the intraday movements of the euro …

Read More »Euro retests support 22/6/2022

EURUSD reached the first awaited target during the previous analysis, at 1.0580, recording its highest level during the last session trading at 1.0582. On the technical side, the pair witnessed a bearish tendency as a result of hitting the resistance level represented by the target of 1.0580, which forced the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations