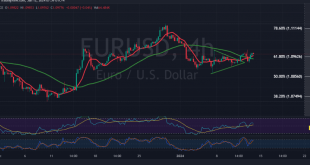

Positive developments were observed in the Euro/Dollar pair’s movements in the previous trading session as it endeavored to offset earlier losses. Leveraging the support at 1.0840, the pair made a resurgence, testing the resistance at 1.0930 once again. In the context of today’s technical analysis, a closer examination of the …

Read More »Euro is experiencing selling pressure 24/1/2024

The EUR/USD pair experienced a significant decline in the previous trading session. In the last technical report, a neutral stance was maintained due to conflicting technical signals. It was emphasized that a drop below 1.0860 would exert negative pressure on the euro, targeting 1.0800, and indeed, it reached its lowest …

Read More »Euro is waiting for a signal of movement 23/1/2024

The EUR/USD pair experienced subdued trading in the initial sessions of the past week without notable changes. From a technical perspective, examining the 4-hour time frame chart reveals the euro’s attempt to establish stability above the 1.0890 resistance level. Concurrently, the Stochastic indicator is showing efforts to gain additional momentum …

Read More »Euro between critical corrections 19/1/2024

We maintained an intraday neutral stance in our previous technical report, citing conflicting technical signals. The EUR/USD pair exhibited limited changes during the last trading session, fluctuating between levels just above 1.0850 and slightly below the psychological resistance barrier of 1.0900. In today’s technical analysis, a closer examination of the …

Read More »Euro between critical corrections 18/1/2024

The EUR/USD pair experienced a session leaning towards negativity, aligning with the anticipated bearish trajectory from the previous report and reaching a low of 1.0844. From a technical standpoint today, examining the 4-hour timeframe chart reveals the pair’s attempt to establish positive stability above the 1.0860 support level, marked by …

Read More »Euro touches the target and negativity persists 17/1/2024

The EUR/USD pair has conformed to the anticipated negative outlook outlined in the previous technical report, reaching the officially targeted level of 1.0865 and hitting a low at 1.0862. In terms of technical analysis today, examining the 240-minute time frame chart reveals continued pressure from the simple moving averages from …

Read More »Euro starts negative against Dollar 16/1/2024

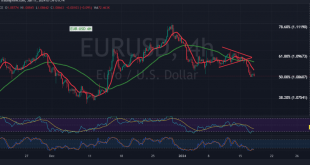

The EUR/USD pair initiated the week with a decline, encountering significant resistance around 1.0960 that prompted a negative trajectory. Presently, the pair is stabilizing near 1.0915. From a technical perspective today, examining the 4-hour timeframe chart reveals persistent pressure on the price from the simple moving averages from above. Additionally, …

Read More »EUR/USD Pair Approaches Key Resistance 12/1/2024

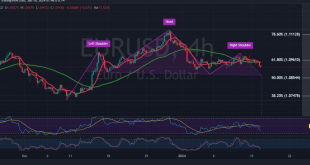

The EUR/USD pair has initiated an assault on the primary resistance level at current trading levels around 1.0960, reaching its highest point close to the psychological barrier of 1.1000. Upon examining the 4-hour time frame chart from a technical analysis perspective, the simple moving averages provide a positive indication, supporting …

Read More »EUR is hovering around resistance 9/1/2024

During the initial trading sessions of the week, the EUR/USD pair exhibited subdued movements, testing the 1.0960 resistance level without successfully breaching it. On the technical front, a closer look at the 240-minute time frame chart reveals the pair’s consolidation below the 50-day simple moving average, exerting downward pressure. Furthermore, …

Read More »EUR touches the downside target 3/1/2024

The EUR/USD pair experienced a significant decline in the previous trading session, aligning with the bearish expectations outlined in the earlier technical report. It touched the second target at 1.0960, marking a low of 1.0938. From a technical standpoint today, a closer examination of the 240-minute time frame chart reveals …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations