Oil, Crude, trading

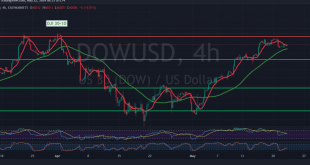

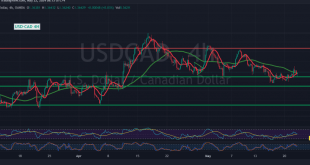

Read More »CAD tends to be negative 22/5/2024

Limited positive trading dominated the Canadian dollar’s movements during the previous session, failing to breach the 1.3675 resistance level and resulting in a negative bias. Technical Analysis Examining the 4-hour chart reveals the following: Stochastic Indicator: Continues to provide negative signals.50-Day Simple Moving Average: Trading stability below this level supports …

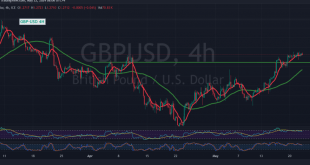

Read More »GBP trying to consolidate against USD 22/5/2024

Oil, Crude, trading

Read More »Oil: facing negative pressure 22/5/2024

US crude oil futures experienced a downward trend in the previous session, encountering resistance at $79.60 per barrel, leading to significant declines and reaching a low of $77.67. Technical Analysis Our outlook remains bearish, based on the following technical factors: Resistance Levels: Intraday trading remains below the key psychological resistance …

Read More »EUR/USD: Bearish Trends Amid Market Volatility 22/5/2024

During the previous trading session, the EUR/USD pair exhibited predominantly sideways trading with a bearish bias, failing to breach the 1.0875 resistance level and consequently recording a lower peak. Technical Analysis A closer examination of the 240-minute chart reveals several bearish signals: Stochastic Indicator: Currently providing negative signals, indicating the …

Read More »German Producer Prices Decline Sharply in April

The federal statistics office reported on Tuesday that German producer prices fell more than anticipated in April, driven primarily by a significant drop in energy prices. Producer prices decreased by 3.3% year-on-year, exceeding analysts’ expectations of a 3.1% decline, according to a Reuters poll. Energy Prices Lead the Decline Energy …

Read More »European Stocks Edge Lower Ahead of Key Inflation Data

European stock markets retreated slightly on Friday, as investors awaited crucial inflation data amidst ongoing uncertainty over future interest rate decisions. At 03:10 ET (07:10 GMT), Germany’s DAX index traded 0.2% lower, France’s CAC 40 slipped 0.1%, and the UK’s FTSE 100 dropped 0.1%. Anticipation Builds for Eurozone CPI Release …

Read More »European Stocks Dip Despite Global Rally, Earnings Weigh

Despite a global rally induced by U.S. inflation data, European stock markets experienced slight declines. The DAX in Germany, the CAC 40 in France, and the FTSE 100 in the U.K. all traded lower, with disappointing corporate earnings contributing to the subdued sentiment. Impact of Earnings Siemens shares dropped nearly …

Read More »Inflation data suggests a rate cut is looming

Wall Street closed Wednesday trading with a big win for risk appetite which managed to beat anxiety prevailed markets because of the second batch of US inflation data a day after the release of producer price data highlighted the rise in inflation to concerning levels that came above expectations. PPI …

Read More »European Stocks Hit Record High on Upbeat Earnings, Await U.S. Inflation Data

Record High for European StocksEurope’s benchmark index surged to a record high on Wednesday, propelled by optimistic earnings reports in the industrial and healthcare sectors. The pan-European STOXX 600 climbed 0.4%, building on its previous record close. Earnings BoostShares of credit data firm Experian soared 7.8% after announcing an optimistic …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations