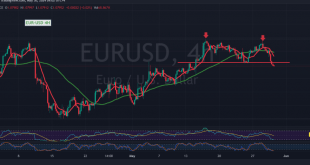

The EUR/USD pair has breached a critical support level at 1.0810, as previously highlighted in our technical analysis. This breach has triggered a wave of selling pressure, driving the pair down to a new low of 1.0790 in early trading. Examining the 4-hour chart, we observe that the euro has …

Read More »European Stocks Dip as Bond Yields Rise, Inflation Worries Weigh

European stock markets experienced a decline on Wednesday, driven by escalating bond yields that unnerved investors ahead of crucial inflation data releases. Fears of prolonged monetary tightening added to the market’s apprehension. Early in the trading session, the DAX index in Germany slipped 0.3%, while the CAC 40 in France …

Read More »Dow Jones extends losses 29/5/2024

Oil, Crude, trading

Read More »Oil is making notable gains 29/5/2024

WTI Crude Oil Prices Set for Further Gains, but Caution Advised WTI crude oil futures prices are on a clear upward trajectory, having recently surpassed the targeted levels of 79.30 and 79.70 and approaching the key psychological level of 80.50. The commodity reached an intraday high of $80.28 per barrel, …

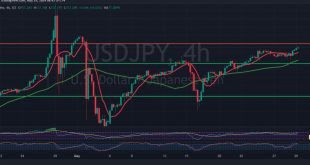

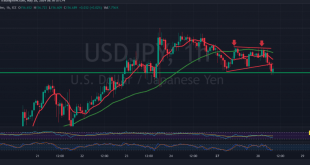

Read More »USD/JPY are recovering 29/5/2024

japanese-yen

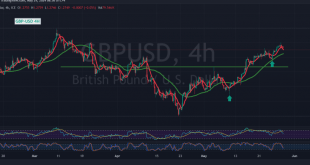

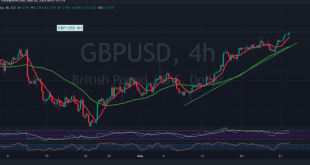

Read More »GBP/USD is testing support 29/5/2024

Oil, Crude, trading

Read More »Euro retests support 29/5/2024

The euro is experiencing a critical moment in its ongoing dance with the U.S. dollar. After a brief flirtation with the 1.0900 resistance level, the pair has retreated to 1.0845, leaving traders pondering its next move. A closer look at the technical landscape reveals a delicate balance between bullish and …

Read More »Dow Jones Faces Downward Pressure Amidst Bearish Technical Signals 28/5/2024

Oil, Crude, trading

Read More »USD/JPY Leans Bearish Amidst Waning Momentum and Key Resistance 28/5/2024

japanese-yen

Read More »GBP/USD Uptrend Continues Amidst Positive Technicals 28/5/2024

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations