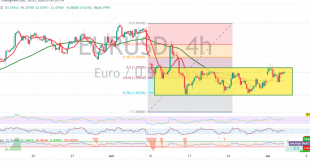

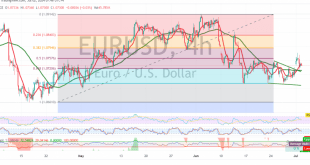

The EUR/USD pair continues to exhibit sideways movement, remaining within the 1.0720 support and 1.0760 resistance levels for the fourth consecutive session. Technical Outlook: On the 4-hour chart, the pair is still consolidating below the key resistance level of 1.0760, which coincides with the 50.0% Fibonacci retracement. While the Stochastic …

Read More »European Stocks Retreat as Post-Election Rally Fades, Inflation Data Awaited

European stocks experienced a decline on Tuesday, reaching a two-week low as the initial relief rally following the first round of French parliamentary elections subsided. Investors now await crucial euro zone inflation data for June, which could provide insights into the future path of interest rates. Market Performance The pan-European …

Read More »Dow Jones: Cautionary Negative Outlook 2/7/2024

Oil, Crude, trading

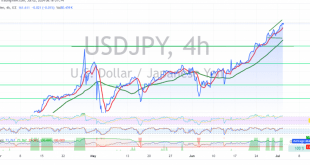

Read More »USD/JPY: Bullish Momentum Drives Pair Higher, New Targets in Sight 2/7/2024

japanese-yen

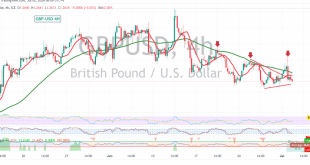

Read More »GBP/USD: Bearish Trend Continues, Downside Targets in Focus 2/7/2024

Oil, Crude, trading

Read More »WTI: Bullish Momentum Continues, Upside Breakout Eyed 2/7/2024

WTI crude oil futures prices surged yesterday, marking the third consecutive week of gains and reaching our previously identified target of 82.90, ultimately peaking at $83.60 per barrel. Technical Outlook: The technical outlook remains strongly bullish. The 4-hour chart reveals continued support from the simple moving averages (SMAs) for the …

Read More »EUR/USD: Range-Bound with Potential Breakout 2/7/2024

The EUR/USD pair has experienced positive trades in early week trading but faces resistance at the 1.0760 level (50.0% Fibonacci retracement). Technical Outlook: On the 4-hour chart, the pair is consolidating below 1.0760, but the simple moving averages (SMAs) are providing support from below, suggesting potential for further upside. However, …

Read More »Eurozone Manufacturing Sector Contracts Further in June as Demand Slumps

The eurozone’s manufacturing sector experienced a deeper contraction in June, as demand plummeted despite factories continuing to lower prices, according to a recent survey. HCOB’s final eurozone manufacturing Purchasing Managers’ Index (PMI), compiled by S&P Global, dropped to 45.8 in June from 47.3 in May, slightly exceeding the preliminary estimate …

Read More »European Stocks Flat as Investors Await Key Economic Data and French Elections

European markets opened cautiously on Thursday, with the pan-European STOXX 600 index holding steady. Investors are refraining from significant moves ahead of critical U.S. inflation (PCE) data due on Friday, which could influence the Federal Reserve’s interest rate decisions. Consumer price data from France, Spain, and Italy this week, as …

Read More »European Stocks Climb Amidst Anticipation for U.S. Inflation Data and French Elections

European shares advanced on Wednesday, fueled by gains in mining and technology stocks, as investors eagerly awaited the release of crucial U.S. inflation data and the outcome of the French elections later in the week. The pan-European STOXX 600 index rose 0.4% by mid-morning, with the technology sector leading the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations