European shares inched higher on Tuesday as investors awaited crucial U.S. economic data expected later in the day, which could offer more insight into the Federal Reserve’s next interest rate move. However, a series of disappointing corporate earnings reports kept gains in check. By 0712 GMT, the STOXX 600 index …

Read More »NFP Data Has Sent Mixed Messages Across Key Assets

Latest NFP data has sent mixed messages to investors, resulting in significant movements across global financial markets, particularly affecting the US dollar, oil, and gold.In July, the Non-Farm Payrolls report showed an increase of 114,000 jobs in the United States, significantly lower than the previous reading of 179,000 jobs and …

Read More »European Shares Fall Amid Global Risk-Off Sentiment and Mixed Corporate Updates

European shares fell over 1% on Friday, aligning with a global risk-off sentiment as investors digested a range of mixed corporate updates to gauge overall market direction. Market Performance The pan-European STOXX 600 index dropped 1.6% to a three-month low by 0718 GMT. Despite the sharp decline, the index is …

Read More »Market Drivers; US Session, August 1

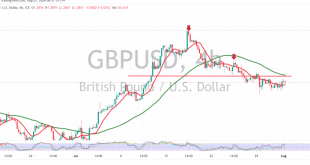

The US dollar emerged as a clear safe-haven asset, rallying significantly amidst a broader risk-off environment. The greenback’s strength was exacerbated by a cautious monetary policy stance adopted by the Bank of England, which opted for a 25 basis point rate cut while expressing concerns about the potential for further …

Read More »What is expected to NFP and other US jobs data? July 2024

The most important US employment data of the month is expected to be released on Friday amid expectations of a significant decline in job growth in the United States, with a stable unemployment rate and a decline in wage growth. On the first Friday of each month, US employment data …

Read More »European shares lower on earnings

Major European equity markets experienced declines on Thursday, impacted by corporate earnings reports from both the U.S. and Europe. Meanwhile, expectations of forthcoming policy easing in the United States supported global bond markets. The Federal Reserve maintained interest rates on Wednesday but hinted at a potential cut in September. Traders …

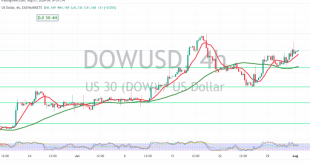

Read More »Dow Jones starts positively 1/8/2024

Oil, Crude, trading

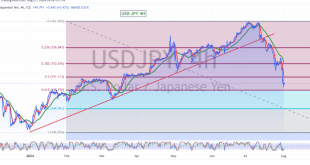

Read More »USD/JPY suffers heavy losses 1/8/2024

japanese-yen

Read More »GBP needs a negative stimulus 1/8/2024

Oil, Crude, trading

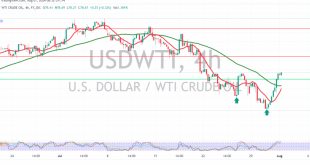

Read More »Oil makes notable gains 1/8/2024

US crude oil futures surged yesterday, reaching a high of $78.70 per barrel. Technically, the 4-hour chart indicates that oil has moved above the 50-day simple moving average, supporting a positive outlook. Additionally, the price is holding above the 78.00 support level. Given this stability, the upward trend appears likely …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations