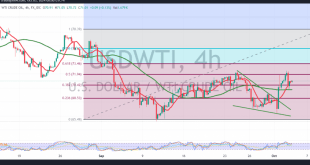

Crude oil prices experienced mixed trading with a positive tendency, reaching a peak at $72.45 per barrel amidst ongoing geopolitical tensions. Technically, the outlook remains cautiously optimistic, with oil prices continuing to receive positive momentum from the 50-day simple moving average. This is supported by stable intraday trading above the …

Read More »Euro presses support 3/10/2024

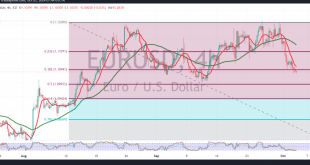

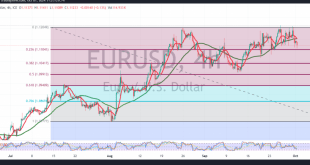

The EUR/USD pair experienced negative trading in the previous session, diverging from the expected upward trend outlined in the last technical report, where we relied on the pair maintaining stability above the psychological support level of 1.1100. As previously indicated, breaking through 1.1100, and more importantly 1.1095, would halt the …

Read More »Dow Jones is trying positively 1/10/2024

Oil, Crude, trading

Read More »USD/JPY breaks resistance 1/10/2024

japanese-yen

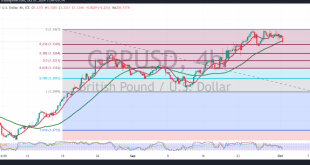

Read More »GBP tries to gain extra momentum 1/10/2024

Oil, Crude, trading

Read More »Oil faces negative pressure 1/10/2024

US crude oil futures experienced significant losses, as anticipated in the previous report, reaching a low of $67.45 per barrel within the bearish trend. Technically, we maintain a cautious negative outlook, relying on the ongoing downward pressure from the simple moving averages, along with the stability of momentary trading below …

Read More »Euro retests support 1/10/2024

Negative trading dominated the movements of the euro against the US dollar during the first trading session of the current week, with the pair encountering a strong resistance level around the psychological barrier of 1.1200, which resulted in a bearish bias. On the technical side today, and with a closer …

Read More »European Shares Dip Amid Economic Data Focus and Auto Sector Weakness

European stocks opened lower on Monday as investors braced for a week filled with key economic data releases from the region, while awaiting remarks from European Central Bank (ECB) President Christine Lagarde. By 07:10 GMT, the pan-European STOXX 600 index had slipped 0.1% to 527.47 points. Despite this slight dip, …

Read More »European Markets Hit New Highs Amid China-Driven Rally

European stock markets reached a fresh record high in mid-morning trading on Friday, fueled by strong momentum from a rally in Asia, led by China. As of 05:13 ET (09:13 GMT), the pan-European Stoxx 600 index rose by 0.3% to 526.92, having previously hit an intraday high of 526.51. Germany’s …

Read More »Dow Jones tries to hold on to gains 27/9/2024

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations