Oil, Crude, trading

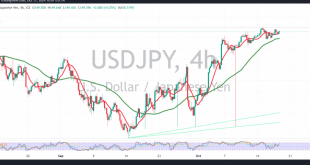

Read More »USD/JPY Repeats Upside Chances 17/10/2024

japanese-yen

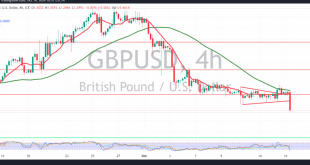

Read More »GBP extends losses against USD 17/10/2024

Oil, Crude, trading

Read More »Oil: Negativity persists 17/10/2024

US crude oil futures remain in a downtrend, recording a low of $69.68, approaching the first target of $69.65 per barrel. Technical Outlook: The bearish double top pattern on the 4-hour chart continues to exert negative pressure on prices. With trading stability below $71.20, the downtrend is likely to persist, …

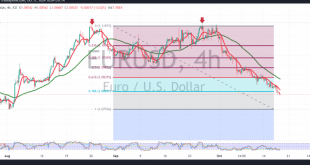

Read More »Euro falls, eyes on ECB 17/10/2024

The Euro continues to decline against the US Dollar, following the expected downward trajectory as noted in the previous analysis, confirming the break of the 1.0880 level. Technical Outlook: Today’s analysis maintains a bearish outlook for the EUR/USD pair, with negative pressure driven by simple moving averages that support continued …

Read More »European Tech and Luxury Stocks Slump Amid Disappointing Earnings and ECB Caution

European tech and luxury stocks took a hit on Wednesday following weak earnings reports from key players like ASML and LVMH, adding to market jitters ahead of the European Central Bank’s (ECB) upcoming policy decision. The STOXX 600 index fell by 0.3%, pulling back further from a recent two-week high. …

Read More »Dow Jones hits resistance 16/10/2024

Oil, Crude, trading

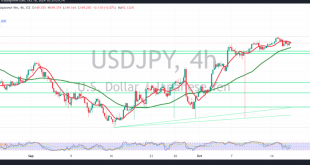

Read More »USD/JPY Seeks Additional Momentum 16/10/2024

japanese-yen

Read More »GBP falls against USD 16/10/2024

Oil, Crude, trading

Read More »Oil: Negative pressure persists 16/10/2024

US crude oil futures experienced a significant decline, hitting the target of $69.65 as mentioned in the previous report, with a recorded low of $69.73 per barrel. The bearish double top pattern on the 4-hour chart continues to exert negative pressure, indicating the potential for the downtrend to persist. As …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations