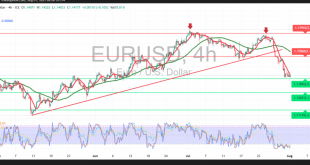

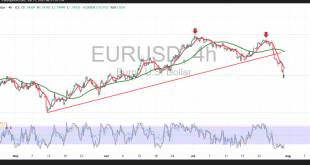

The EUR/USD pair traded within a bearish sideways range during the previous session, maintaining alignment with the prevailing negative outlook. The pair approached the key psychological barrier at 1.1400, recording its lowest level near that threshold. Technical Outlook: Currently, the pair is attempting a limited rebound to recover part of …

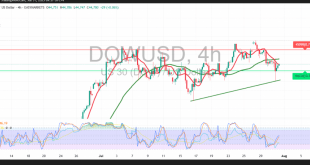

Read More »Mixed Movements for Dow Jones — Support at 44,485 Under Watch 31/7/2025

DowJones

Read More »Canadian Dollar Continues Its Gradual Rise 31/7/2025

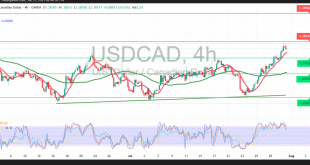

The USD/CAD pair continued to follow the bullish outlook highlighted in our previous report, successfully reaching the official target of 1.3840 and recording a session high of 1.3845. Technical Outlook: The pair maintains a strong upward trajectory, supported by continued price stability above key Simple Moving Averages (SMAs), which act …

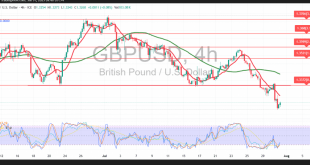

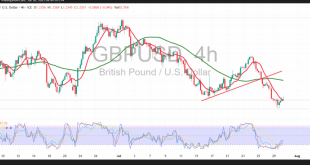

Read More »GBP Falls Under Heavy Selling Pressure 31/7/2025

Oil, Crude, trading

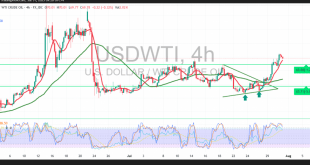

Read More »Crude Slips Briefly Amid Profit-Taking, Is More Upside Ahead? 31/7/2025

U.S. crude oil futures surged during the previous trading session, aligning with the bullish expectations outlined in our prior report. The price successfully reached the official target at $70.40, marking a session high of $70.48 per barrel. Technical Outlook: Following the recent rally, intraday movements are showing modest pullbacks, likely …

Read More »EUR Deepens Its Decline Versus the USD 31/7/2025

The euro continues to extend its losses against the U.S. dollar, aligning with the bearish outlook presented in previous reports. The pair reached the anticipated technical target at 1.1445 and registered a new low at 1.1405. Technical Outlook: Currently, the pair is undergoing a limited recovery attempt, aiming to retrace …

Read More »U.S. Economy Grows at a Strong 3% Annual Rate in Q2, Surpassing Expectations

The U.S. economy expanded at a 3% annualized rate in the second quarter of 2025, according to the Bureau of Economic Analysis’ (BEA) first estimate, released on Wednesday. This marks a significant rebound from the 0.5% contraction recorded in the first quarter and comes well above market expectations, which had …

Read More »Dow Jones Encounters Strong Resistance 30/7/2025

DowJones

Read More »Canadian Dollar Receives Positive Signals 30/7/2025

The USD/CAD pair confirmed the bullish outlook outlined in our previous report, reaching the initial target at 1.3780 and registering a session high of 1.3788. Technical Outlook: Intraday price action continues to reflect a strong bullish trend, supported by sustained stability above the key Simple Moving Averages (SMAs), which serve …

Read More »Sterling Trapped Under the Weight of a Strong Dollar 30/7/2025

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations