European shares ticked up on Tuesday, fueled by anticipation for major U.S. tech earnings, while the dollar remained near a three-month high as investors braced for key U.S. labor market data. The pan-European STOXX 600 rose 0.3%, reaching its highest level in over a week. Major European indices were similarly …

Read More »Dow Jones tries to recover 29/10/2024

Oil, Crude, trading

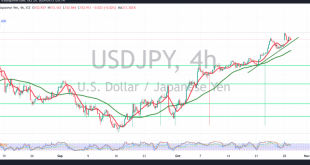

Read More »USDJPY trying positively 29/10/2024

japanese-yen

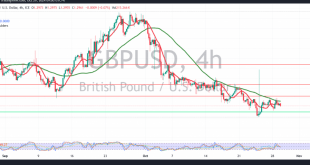

Read More »GBP faces negative pressure 29/10/2024

Oil, Crude, trading

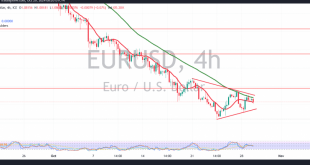

Read More »Euro awaits confirmation of break 29/10/2024

The EUR/USD pair has been trading sideways, attempting to hold above the support level of 1.0760. However, positive movement has been limited, with the pair struggling to rise above the main resistance at 1.0850. Technical Analysis: On the 240-minute chart, the 50-day simple moving average indicates potential for further decline, …

Read More »US Dollar Retreats Amid Profit-Taking and Anticipation of Key Economic Data

US Dollar Pauses as Profit-Taking Sets In, Key Economic Data AwaitedThe US Dollar Index (DXY) retreated on Monday after a recent rally, as investors took profits ahead of a pivotal week for economic data releases. While the US economy continues to show signs of strength, concerns about potential interest rate …

Read More »European Stocks Edge Higher Amid Easing Middle East Tensions and Event-Heavy Week

European stock markets saw modest gains on Monday as easing tensions in the Middle East provided a positive backdrop at the start of a week loaded with key economic events. By 04:10 ET (08:10 GMT), Germany’s DAX rose 0.3%, France’s CAC 40 gained 0.5%, while the U.K.’s FTSE 100 slipped …

Read More »European Markets Drift as Earnings Take Center Stage Amid Growth Concerns

European stock markets saw modest movement on Wednesday as investors digested a wave of third-quarter corporate earnings reports against a backdrop of regional economic uncertainty. By 03:05 ET (07:05 GMT), Germany’s DAX index and France’s CAC 40 both edged 0.1% lower, while the U.K.’s FTSE 100 managed to climb by …

Read More »European Stocks Slip Amid Geopolitical and Rate-Cut Uncertainties, SAP Boosts Tech Sector

European stocks dipped on Tuesday as investors grappled with geopolitical tensions and uncertainties over global interest rate cuts. The pan-European STOXX 600 index edged down 0.3% by 0830 GMT, as lingering concerns about the European economy and Chinese demand weighed on market sentiment. The broader decline was softened by German …

Read More »European Shares Struggle Ahead of Key Corporate Earnings, Energy Stocks Lead Gains

European shares wavered on Monday after two consecutive weeks of gains, as investors awaited key corporate earnings reports, with stabilizing oil prices supporting the energy sector. The pan-European STOXX 600 index remained flat at 0845 GMT, fluctuating between minor gains and losses. Last week, the STOXX 600 gained momentum following …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations