Negative trading dominated the Canadian dollar’s movements yesterday within the expected bearish context, touching the first target to be achieved during the previous session at 1.2560, recording its lowest price of 1.2560. Technically speaking, and with a closer look at the 60-minute chart, we find that Stochastic started to provide …

Read More »The Pound Touches The Desired Target

Oil, Crude, trading

Read More »Oil May Witness a Temporary Decline

Oil, Crude, trading

Read More »The Euro is Testing Resistance And Positivity Looking For Confirmation

The single European currency continues to try to rise against the US dollar, recording its highest level during the previous session at 1.1280. Technically speaking, we see the Euro found it difficult to confirm the breach of the 1.2175 resistance level represented by the 23.60% Fibonacci correction as shown on …

Read More »Canadian Dollar: Pressure on Support

Quiet trading, which tends to be negative, dominates the movements of the US dollar against the Canadian dollar, as the pair begins negative pressure on the support level of 1.2590. Technically, with a closer look at the chart, there is negative pressure coming from the 50-day moving average and trading …

Read More »The Pound Continues to Advance

Oil, Crude, trading

Read More »Oil Achieves Strong Gains

Oil, Crude, trading

Read More »Euro Continues to Rising

Positive moves dominated the euro against the US dollar during the previous trading session. To remind us, we mentioned in the last report that the attempt to breach the resistance level at 1.2115 paves the way for the pair to retest the pivotal resistance level of 1.2175, recording a high …

Read More »Currencies Overview: The Dollar Trimmed Losses on Yields Rising

The dollar trimmed its losses in early European trade after reaching its lowest level in several years against the pound sterling and the currencies of Australia and New Zealand, as bond yields rose in light of progress in Corona’s immunization programs and expectations of an acceleration of economic growth and …

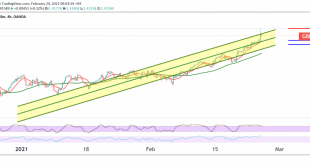

Read More »Canadian Dollar Maintains Bullish Direction

The technical outlook remains unchanged, and the pair’s movements have not changed significantly, maintaining the positive stability within the context of an upward correction. Technically speaking, we find the price is stable above the previously breached resistance level, which has now converted to the support level of 1.2660, and we …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations