US crude oil futures experienced mixed trading, attempting to pare losses after reaching a low of $67.78 per barrel. From a technical standpoint, oil prices remain under negative pressure, driven by continued movement below the simple moving averages. Additionally, the price is currently stabilizing below the key resistance level at …

Read More »Euro continues to fall against dollar 13/11/2024

The Euro continues to decline, pressured by the strengthening US dollar. The pair reached the initial target outlined in our previous report at 1.0600, with the lowest recorded level at 1.0595. From a technical perspective, examining the 240-minute chart reveals persistent negative pressure from the simple moving averages, which act …

Read More »European Stocks Dip as Inflation and Employment Data Weigh on Sentiment

European stock markets fell on Tuesday morning as investors assessed fresh economic data from the region, particularly inflation and employment figures, alongside quarterly earnings updates from key corporations. At 03:10 ET (08:10 GMT), Germany’s DAX was down 0.9%, France’s CAC 40 dropped 1%, and London’s FTSE 100 slipped by 0.4%. …

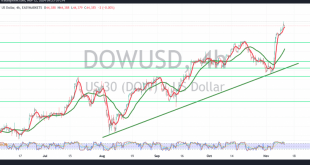

Read More »Dow Jones needs extra momentum 12/11/2024

Oil, Crude, trading

Read More »USD/JPY continues gradual rise 12/11/2024

japanese-yen

Read More »GBP continues its gradual decline 12/11/2024

Oil, Crude, trading

Read More »Oil continues to make losses 12/11/2024

US crude oil futures prices experienced a significant decline in the last trading session, aligning with the bearish outlook, and met the forecasted targets at 68.55, hitting a session low of $67.84 per barrel. Technical Analysis: Bearish Bias: Oil prices are currently under negative pressure, with trading stability below 68.60. …

Read More »Euro continues to fall against dollar 12/11/2024

The Euro experienced a significant decline against the U.S. Dollar, in line with previous expectations, after successfully breaking the 1.0680 support level. This move took the pair down to its initial target at 1.0665, coming close to the next key station at 1.0610, with a recorded low of 1.0628. Technical …

Read More »Market Review: Euro Dips to 4-Month Low Against Dollar Amid Tariff Fears and U.S. Policy Uncertainty

The euro fell to its lowest level in 4 and a half months against the U.S. dollar on Monday, as concerns about potential U.S. tariffs weighed heavily on the currency and investors reacted to growing uncertainties surrounding U.S. economic policy under President-elect Donald Trump. At 10:00 GMT, the euro was …

Read More »European Stocks Rise Amid Wall Street Momentum and Federal Reserve Rate Cut

European stock markets kicked off the week on a high note, buoyed by record gains from Wall Street and recent moves by the U.S. Federal Reserve to lower interest rates. By 03:10 ET (08:10 GMT), key indices showed robust gains: Germany’s DAX was up 1.1%, France’s CAC 40 increased by …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations