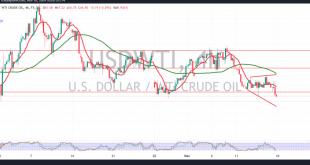

US crude oil futures have shown a strong upward momentum, crossing a key resistance level at 68.65, signaling a shift toward a potential bullish trend. Technical Analysis Overview:On the 240-minute chart, the technical setup is promising, with the 14-day momentum indicator attempting to generate positive signals. Furthermore, the 50-day simple …

Read More »Euro retests resistance 19/11/2024

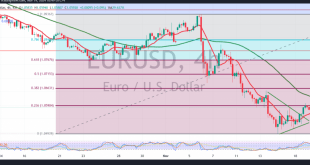

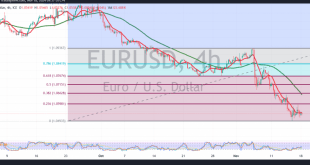

The Euro made some gains against the US Dollar during the previous trading session, attempting to retest the psychological barrier resistance level at 1.0600. From a technical standpoint, the pair is currently hovering around this resistance, which aligns with the 23.60% Fibonacci correction on the 4-hour chart. The Stochastic indicator …

Read More »Market Drivers; US Session

Market Update: Dollar Weakens, Euro and Pound Strengthen The US Dollar continued its downward trend on Tuesday, November 19th, as the initial enthusiasm for the Trump rally seems to have waned. This potential temporary dip could lead to another “buy the dip” opportunity. Key Events and Economic Data: US Dollar: …

Read More »European Shares Decline Amid Real Estate and Tech Weakness; Investors Eye ECB Guidance

European shares slipped on Monday, marking further losses in the wake of recent setbacks. The STOXX 600 index dropped 0.2% by 0909 GMT, extending concerns from a four-week losing streak. This decline, the longest in 2.5 years, was fueled by disappointing earnings, rising Treasury yields, and uncertainty over U.S. President-elect …

Read More »Dow Jones: Downside pressure persists 18/11/2024

Oil, Crude, trading

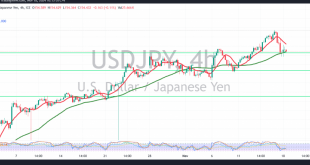

Read More »USD/JPY Retests Support 18/11/2024

japanese-yen

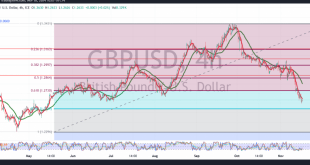

Read More »GBP falls as dollar continues to rise 18/11/2024

Oil, Crude, trading

Read More »Oil settles below resistance 18/11/2024

US crude oil futures experienced sharp declines at the start of the week, bottoming out at $66.84 per barrel. From a technical standpoint, the 4-hour chart reveals that oil prices have decisively broken below the support level of $68.65. The persistent downward pressure from the simple moving averages continues to …

Read More »Euro expected to fall further 18/11/2024

The US dollar continues to exert downward pressure on the euro, hitting the first official target highlighted in the previous technical report at 1.0510, with a recorded low of 1.0515. From a technical standpoint, and based on a closer analysis of the 4-hour chart, the pair remains stable below the …

Read More »European Markets End the Week Lower, Technology and Healthcare Lead Declines

The pan-European STOXX 600 index dropped 0.5% on Friday, heading toward its fourth consecutive weekly decline as technology and healthcare stocks led the losses. The index remained close to a three-month low, reflecting a week of negative sentiment and disappointing sector performance. The technology sub-index fell by 1.7%, with chipmaker …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations