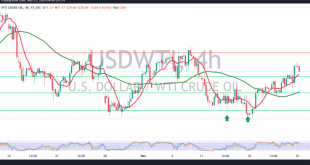

Oil, Crude, trading

Read More »Oil is based on support 25/11/2024

US crude oil futures closed last week’s trading on a positive note, reaching a high of $71.47 per barrel. From a technical standpoint, the outlook remains optimistic, supported by the price’s ability to stabilize above the key support level of $70.60. Additionally, the RSI is showing attempts to gain further …

Read More »Euro tries to recover 25/11/2024

The EUR/USD pair attempted a recovery after several sessions of decline, hitting a low of 1.0330 before opening today’s trading with an upward gap. Technical Outlook: Indicators: The 4-hour chart reveals negative crossover signals from the Stochastic indicator, now in the overbought zone, coupled with continued downward pressure from the …

Read More »DXY closes trading week strong Despite paring some gains

The US Dollar Index (DXY) experienced a slight pullback on Friday, November 22nd, after reaching a two-year high amidst ongoing geopolitical tensions. While the robust S&P PMI data underscored the resilience of the US economy, supporting the DXY’s upward trajectory, several factors contributed to its decline.Firstly, profit-taking emerged as a …

Read More »European Equity Markets Rise Amid Heightened Geopolitical Tensions

European stock markets opened higher on Friday as investors kept a close eye on escalating conflict between Russia and Ukraine and assessed Germany’s downwardly revised economic growth figures for Q3. Market Overview Germany’s DAX: Up 0.6% France’s CAC 40: Up 0.5% UK’s FTSE 100: Up 0.7% Geopolitical Escalation: Russia-Ukraine Conflict …

Read More »European Stocks Rebound as Technology Sector Leads Gains Amid Ukraine-Russia Developments

European markets regained footing on Wednesday, breaking a three-day losing streak, as technology stocks surged and safe-haven demand eased amidst renewed focus on geopolitical and economic developments. The pan-European STOXX 600 rose 0.5% as of 09:20 GMT, recovering from a three-month low touched on Tuesday. Major indices in Germany, France, …

Read More »Geopolitical Tensions and Inflation Concerns Weigh on European Stocks

Europe’s main stock index dropped to a three-month low on Tuesday as investor sentiment soured amidst escalating geopolitical risks and inflationary concerns linked to U.S. policies under President-elect Donald Trump. The pan-European STOXX 600 index fell 0.9%, on track for its third consecutive day of losses. Safe-haven assets, such as …

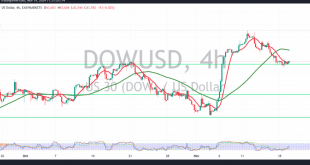

Read More »Dow Jones steady below resistance 19/11/2024

Oil, Crude, trading

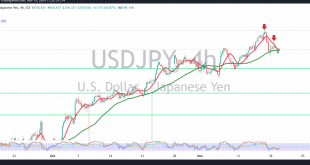

Read More »USD/JPY may start downward correction 19/11/2024

japanese-yen

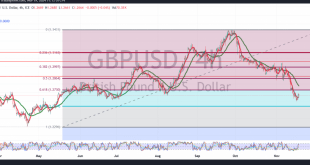

Read More »GBP awaits confirmation signal in the short term 19/11/2024

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations