The resistance levels published during the previous analysis, at 1.1640, were able to cap the attempts to rise in the euro against the US dollar, which forced it to decline again. Technically, and by looking at the 4-hour chart, we notice the continuation of the negative pressure coming from the …

Read More »CAD Awaits Pending Orders

The Canadian dollar faced intense negative pressure at the end of last week’s trading. It started the first weekly trading with a bearish tendency; after it failed to settle above the 1.2665 level, it started the first weekly trading with a bearish tendency. Technically, we notice a contradiction between the …

Read More »GBP: Faces Strong Resistance

Oil, Crude, trading

Read More »Oil is Based on Support And Positivity Remains

Oil, Crude, trading

Read More »Euro Continues to Negative

The single European currency started its first weekly trading, maintaining the negative stability, and the current movements of the pair are witnessing stability below the psychological barrier of 1.1600. Technically, by looking at the 4-hour chart, we notice the continuation of the apparent negative signs on the stochastic indicator, accompanied …

Read More »The Dollar is Heading For The Best week in Months

The dollar started the fourth quarter of 2021 near its highest levels in the year and is heading towards achieving its best weekly performance since June, as investors expect the Federal Reserve, which appears to be inclined towards monetary tightening, to raise interest rates at a faster pace than its …

Read More »CAD at Solid Support

The Canadian dollar found solid support around the 1.2630 level, which forced it to trade positively again within a bullish bounce that aimed to retest 1.2720. Technically, today, the current moves see the price stability above the 1.2660 support level at the 61.80% Fibonacci level. We also notice the positive …

Read More »The Pound Faces a Conflict in Technical Signals

Oil, Crude, trading

Read More »Oil May Face a Temporary Downward Trend

Oil, Crude, trading

Read More »Euro in The Negative Territory, Selling Pressure Continues

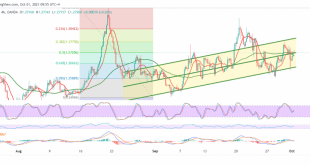

The single European currency succeeded in achieving the official target of the current downside wave published during the last analysis, located at the price of 1.1600, to record its lowest level against the US dollar at 1.1562. Technically speaking, the 4-hour chart paints the regularity of the movement inside the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations