Oil, Crude, trading

Read More »Oil awaits new move signal 5/12/2024

US crude oil futures demonstrated the anticipated upward trend outlined in the previous technical report, supported by trading stability above the key level of 68.90. Technical Analysis: Bearish Indicators: The simple moving averages apply continued downward pressure. The 14-day momentum indicator reflects clear negative signals, favoring a bearish outlook. Scenario …

Read More »Euro loses momentum 5/12/2024

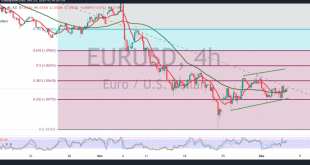

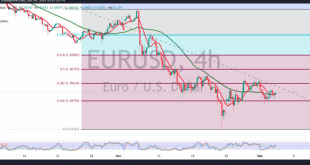

The EUR/USD pair showed a modest upward trend, benefiting from the support level of 1.0470, and reached a session high of 1.0544 during the previous trading day. Technical Analysis: The pair struggled to break the critical resistance at 1.0540, as noted in the previous analysis. On the 4-hour chart, the …

Read More »US Dollar Gains as Euro Struggles Ahead of French Political Crisis

The US dollar strengthened on Wednesday, while the euro retreated ahead of a critical no-confidence vote in France that could potentially destabilize the already fragile coalition government. Dollar Rises on Safe-Haven Demand At 04:45 ET (09:45 GMT), the Dollar Index, which tracks the greenback against a basket of six major …

Read More »European Markets Steady Ahead of French No-Confidence Vote

European equities opened Wednesday on a cautious note as investors awaited a decisive no-confidence vote in France’s Parliament, a move that could potentially unseat Prime Minister Michel Barnier’s government. Market Overview The pan-European STOXX 600 index edged up 0.1% by 0810 GMT, marking its fifth consecutive session of gains after …

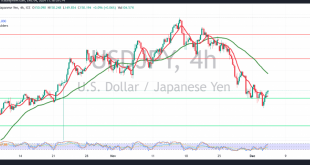

Read More »USD/JPY Below Resistance 4/12/2024

japanese-yen

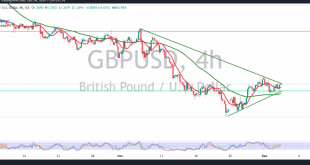

Read More »GBP under negative pressure 4/12/2024

Oil, Crude, trading

Read More »Oil starts positive 4/12/2024

US crude oil futures displayed bullish attempts in the previous session, reaching a high of $70.20 per barrel. From a technical perspective, the outlook remains positive, supported by the bullish crossover of simple moving averages that align with the daily upward trajectory. Furthermore, the price stability above the key support …

Read More »Euro is looking for a movement signal 4/12/2024

Narrow sideways trading dominates the movements of the euro against the US dollar, confined from below above 1.0480 and from above without resistance 1.0510. On the technical side today, and with a closer look at the 4-hour chart, we find that the simple moving averages still support the possibility of …

Read More »Dollar Weakens, Gold Shines Amidst Fed Rate Cut Expectations

A Shift in the Monetary Landscape The global currency and commodity markets experienced a significant shift this week as expectations for a Federal Reserve rate cut intensified. The US dollar, long considered a safe-haven asset, weakened as investors sought opportunities in other currencies and commodities.Fed’s Dovish TurnA key catalyst for …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations