Oil, Crude, trading

Read More »Oil: Negative pressure persists 9/12/2024

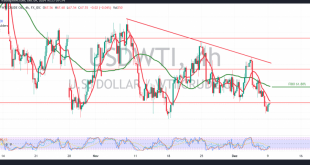

US crude oil futures prices continue their bearish trajectory, aligning with the previous negative outlook. The price reached the official target at 67.00, recording a low of $67.05 per barrel. Technical Analysis: 240-Minute Chart Observations: The simple moving averages maintain downward pressure. The 14-day momentum indicator shows strong negative signals, …

Read More »Euro seeks additional momentum 9/12/2024

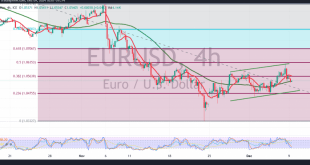

The EUR/USD pair ended last week’s trading on a bullish note, surpassing the 1.0560 resistance level and reaching the target of 1.0635, marking its highest level at 1.0635. Technical Analysis: Momentum Indicators: The 240-minute chart shows support from the 50-day simple moving average, alongside the Stochastic indicator signaling positive momentum, …

Read More »Dollar Dives as Fed Rate Cut Looms

The US Dollar weakened significantly following the release of the November Nonfarm Payrolls report. The 227,000 jobs added, while still positive, fell short of market expectations. This, combined with recent economic indicators, has fueled speculation about a potential rate cut by the Federal Reserve in December.The market’s reaction was swift, …

Read More »U.S. Nonfarm Payrolls Exceed Expectations with Strong November Growth

The U.S. labor market demonstrated resilience in November as Nonfarm Payrolls (NFP) increased by 227,000, according to the Bureau of Labor Statistics (BLS) report released on Friday. This robust figure surpassed market expectations of 200,000 and significantly outpaced October’s revised gain of 36,000, which had initially been reported as just …

Read More »US Dollar Marginally Higher Ahead of Jobs Report; Euro Weakens on German Data

The US dollar edged higher on Friday as traders adopted a cautious approach ahead of the release of the US monthly jobs report, while the euro remained under pressure due to weak German industrial data and ongoing political uncertainty in France. At 05:00 ET (10:00 GMT), the Dollar Index, which …

Read More »European Shares Flat Ahead of U.S. Payrolls Data; French Political Developments in Focus

European stock markets showed little movement on Friday, as investors awaited the release of U.S. nonfarm payrolls data, a critical factor in shaping Federal Reserve policy expectations for the coming months. Ongoing political shifts in France and South Korea also remained under watch. Market Highlights: STOXX 600: Down 0.04% by …

Read More »European Stocks Near One-Month Highs Amid French Political Developments

European equities remained steady on Thursday, approaching one-month highs, as French markets absorbed the political upheaval following a no-confidence vote that ousted Prime Minister Michel Barnier’s government. Market Highlights STOXX 600: Rose 0.1%, marking its sixth consecutive session of gains. France’s CAC 40: Mirrored regional trends with a 0.1% uptick. …

Read More »Dow Jones makes big gains 5/12/2024

Oil, Crude, trading

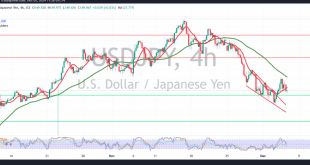

Read More »USD/JPY Waiting for Stronger Trend Signal 5/12/2024

japanese-yen

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations