European stock markets opened in the red on Tuesday as weak trade data from China dampened the momentum created by recent stimulus pledges. Investors are now turning their attention to upcoming U.S. inflation data, which could influence monetary policy decisions. Market Performance STOXX 600 index fell 0.2% to 520.02 by …

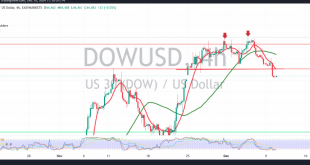

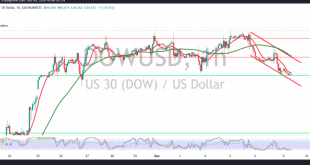

Read More »Dow Jones touches desired targets 10/12/2024

Oil, Crude, trading

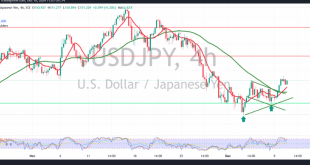

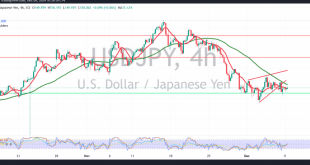

Read More »USD/JPY Draws Bullish Pattern 10/12/2024

japanese-yen

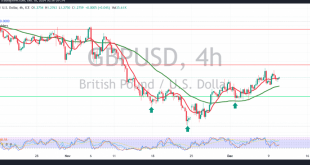

Read More »GBP touches targets, positivity remains 10/12/2024

Oil, Crude, trading

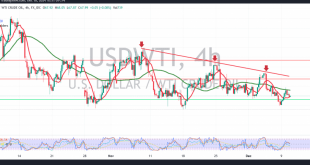

Read More »Oil hits resistance 10/12/2024

US crude oil futures attempted to move higher in the previous session, challenging the pivotal resistance level of 68.60 and reaching a peak of $68.85 per barrel. Technically, analysis of the 240-minute chart suggests that negativity prevails due to sustained downward pressure from the simple moving averages. Additionally, the price …

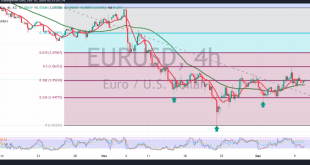

Read More »Euro trying to recover 10/12/2024

The EUR/USD pair maintained its upward trajectory within the anticipated positive outlook highlighted in the previous technical report, reaching the first target of 1.0600 and recording a high of 1.0597. Technically, today’s analysis of the 4-hour chart shows the 50-day simple moving average supporting the bullish movement, alongside positive momentum …

Read More »US Dollar Dips as Geopolitical Risks Weigh Amid Economic Data Focus

The US dollar edged lower on Monday, as traders digested last week’s jobs report pointing toward a likely Federal Reserve rate cut later this month. However, the greenback’s losses were modest, supported by ongoing geopolitical instability in the Middle East. Dollar Shows Signs of Weakness By 04:00 ET (09:00 GMT), …

Read More »European Shares Near Six-Week Highs on China Stimulus Hopes

European stocks hovered near six-week highs on Monday, buoyed by gains in mining and luxury sectors following signs of stimulus measures aimed at reviving China’s slowing economy. Market Overview The pan-European STOXX 600 index edged up 0.1% by 1000 GMT, extending its rally to an eighth consecutive session. However, Germany’s …

Read More »Dow Jones faces temporary negative pressure 9/12/2024

Oil, Crude, trading

Read More »USD/JPY Steady Below Resistance 9/12/2024

japanese-yen

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations