Oil, Crude, trading

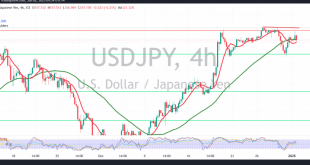

Read More »USD/JPY negative pressure remains 3/1/2025

japanese-yen

Read More »Oil needs positive stimulus to continue rising 3/1/2025

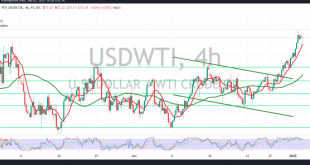

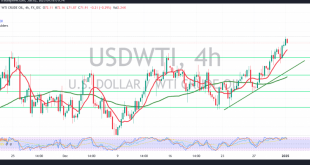

US crude oil futures posted notable gains during the previous session, aligning with the positive outlook outlined in the prior report. The price reached the official target of 73.00, recording a high of $73.69 per barrel. Technical Outlook:The technical indicators continue to favor a bullish bias. The simple moving averages …

Read More »Euro touches official target 3/1/2025

As anticipated in the previous report, the EUR/USD pair extended its strong downtrend, achieving the target of 1.0250 and marking a low of 1.0220. Technical Outlook:A closer look at the 4-hour chart highlights continued bearish pressure from the 50-day simple moving average. However, the Stochastic indicator is beginning to show …

Read More »European Stocks Struggle Amid Valuation Concerns and U.S. Policy Uncertainty

European stocks fluctuated on the first trading session of 2025, as investor sentiment remained cautious following a late-year selloff driven by concerns over high valuations and potential policy shifts under incoming U.S. President Donald Trump. The pan-European STOXX 600 index dipped 0.2% by 0946 GMT, erasing earlier gains as trading …

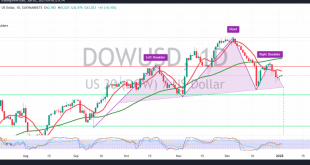

Read More »Dow Jones: Downside pressure persists 2/1/2025

Oil, Crude, trading

Read More »USD/JPY may start downward correction 2/1/2025

japanese-yen

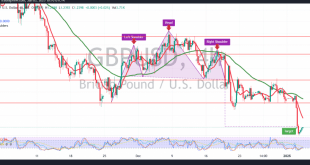

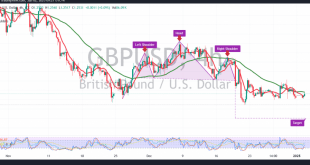

Read More »GBP Negative pressure persists 2/1/2025

Oil, Crude, trading

Read More »Oil may extend gains 2/1/2025

US crude oil futures maintained an upward trajectory in line with the positive outlook outlined in the previous report, successfully reaching the anticipated target of $72.20 and recording a peak of $72.25 per barrel. Technical Outlook:The bullish bias remains dominant, supported by positive momentum from the simple moving averages and …

Read More »Euro tries with limited positivity 2/1/2025

The EUR/USD pair concluded last year’s trading with predominantly negative performance, aligning with the bearish scenario outlined in the previous technical report. The pair came within a few points of the anticipated target at 1.0330, reaching a low of 1.0340. Technical Overview:In today’s session, the pair attempted a limited upward …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations