European stock markets remained relatively stable on Wednesday as investors evaluated a series of major corporate earnings while awaiting policy decisions from both the European Central Bank (ECB) and the U.S. Federal Reserve. As of 03:05 ET (08:05 GMT): Germany’s DAX rose 0.4% France’s CAC 40 slipped 0.4% UK’s FTSE …

Read More »Dow Jones touches desired target 29/1/2025

Oil, Crude, trading

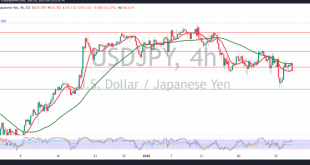

Read More »USD/JPY: Waiting for a Move Signal 29/1/2025

japanese-yen

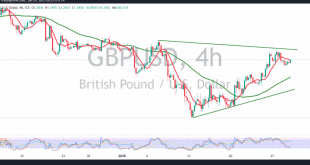

Read More »GBP tests support 29/1/2025

Oil, Crude, trading

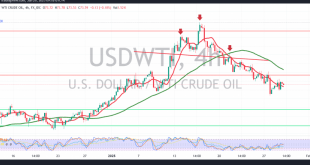

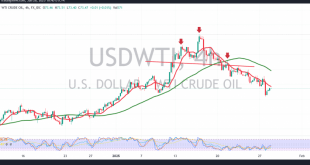

Read More »Oil: Negative pressure persists 29/1/2025

Negative pressure continues to dominate U.S. crude oil futures, with prices reaching a low of $72.95 per barrel during the previous session. From a technical perspective, the 4-hour chart reveals a bearish head and shoulders formation, with the price remaining below 74.25, further pressured by negative signals from the simple …

Read More »Euro may continue gradual decline 29/1/2025

The EUR/USD pair remains in narrow sideways trading, gradually declining toward the first target of 1.0400, after recording its lowest price at 1.0414. From a technical analysis perspective, the 4-hour chart shows the pair stabilizing below the key resistance levels of 1.0460 and, more importantly, 1.0485. Additionally, the 14-day momentum …

Read More »Dow Jones tries to hold above support 28/1/2025

Oil, Crude, trading

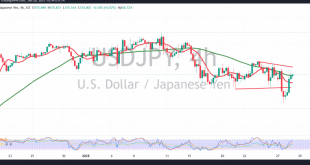

Read More »USD/JPY: to be monitored 28/1/2025

japanese-yen

Read More »GBP may retest support 28/1/2025

Oil, Crude, trading

Read More »Oil: Bearish Technical Structure 28/1/2025

A bearish trend dominated US crude oil futures prices during the early trading sessions this week, with prices reaching their lowest level at $72.42 per barrel. From a technical standpoint, examining the 4-hour chart reveals the formation of a bearish inverted head and shoulders pattern. Additionally, oil prices remain below …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations