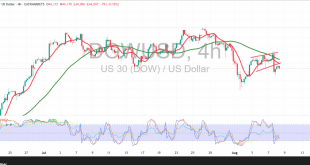

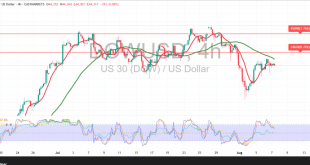

DowJones

Read More »CAD Holds Steady Amid Unchanged Technical Setup 8/8/2025

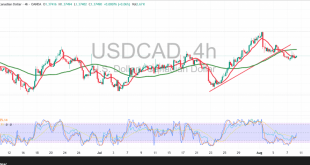

Mixed price action characterized the USD/CAD pair during the previous trading session, as the pair tested the 1.3770 resistance level, which effectively capped the weak bullish attempts. Technical Outlook: Current technical indicators suggest a potential resumption of the broader downtrend. This is reinforced by continued pressure from the 50-period Simple …

Read More »GBP/USD Uptrend Loses Steam — Is a Reversal Coming? 8/8/2025

Oil, Crude, trading

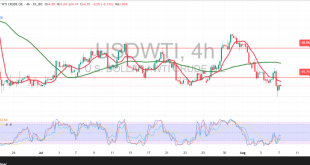

Read More »Oil Slips Below $65 Resistance as Bearish Trend Takes Hold 8/8/2025

In our previous technical report, we maintained a neutral stance due to conflicting signals. However, recent price action has confirmed the continued dominance of the downtrend, with U.S. crude oil futures experiencing renewed bearish pressure in recent hours. Technical Outlook: After testing the strong psychological resistance at $65.00, prices sharply …

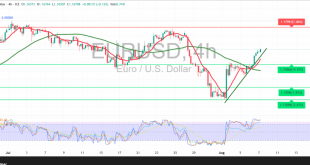

Read More »Euro Reaches Target Level, Maintains Gains on Bullish Technicals 8/8/2025

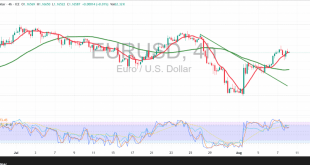

The EUR/USD pair has successfully maintained its upward momentum, in line with our previous bullish outlook. The pair approached the first official target at 1.1700, registering a session high of 1.1698. Technical Outlook: The pair continues to show a clear bullish bias, supported by price stability above the 50-period Simple …

Read More »Dow Jones Attempts a Cautious Climb 7/8/2025

DowJones

Read More »Canadian Dollar Breaks the Uptrend Line 7/8/2025

In our previous report, we maintained a neutral stance due to conflicting market signals. However, a clear bearish development has since occurred, as the support level at 1.3760 was broken, potentially triggered by early-session momentum at 1.3720. The pair has since recorded its lowest level of the session at 1.3729. …

Read More »GBP Rally Dependent on BoE Policy Verdict 7/8/2025

Oil, Crude, trading

Read More »Crude Oil: Rebound Attempts Shadowed by Downside Risks 7/8/2025

U.S. crude oil extended its losses as anticipated in our previous report, surpassing the initial downside target of $64.35 and recording a session low of $63.66 per barrel. Technical Outlook: Following multiple sessions of decline, oil prices are attempting a modest rebound, supported by price stabilization above the psychological threshold …

Read More »EUR/USD Maintains Bullish Momentum Despite Overbought Signals 7/8/2025

The EUR/USD pair successfully reached the bullish target at 1.1665, in line with the positive outlook presented in our previous report. The pair recorded a session high of 1.1676, confirming the continuation of its upward momentum. Technical Outlook: Price action remains steady above the 50-period Simple Moving Average (SMA), which …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations