European stock markets edged lower on Wednesday as investors digested corporate earnings, global trade tensions, and upcoming economic activity data from the region. At 08:05 GMT (03:05 ET): Germany’s DAX fell 0.4% France’s CAC 40 declined 0.2% UK’s FTSE 100 slipped 0.1% Trade War Fears Weigh on Sentiment Market caution …

Read More »European Markets Decline as Trade War Concerns Weigh on Sentiment

European equities edged lower on Tuesday, pressured by declines in automobile and telecom stocks, as escalating trade tensions between the United States and China unsettled investors. The pan-European STOXX 600 index declined 0.3% in early trading, extending losses from Monday when the benchmark posted its largest single-day drop in over …

Read More »European Markets Drop as Trump Tariffs Spark Global Selloff

European stocks retreated sharply on Monday, mirroring a global selloff as investors feared an escalating trade war after U.S. President Donald Trump imposed new tariffs on China, Canada, and Mexico. Market Reaction: STOXX 600 index fell 1.4% by 0810 GMT S&P 500 futures dropped 1.3%, signaling a weak Wall Street …

Read More »European Stocks Edge Higher as ECB Rate Cut Boosts Sentiment

European stock markets rose slightly on Friday, supported by the European Central Bank’s (ECB) interest rate cut, while investors assessed corporate earnings and inflation data across the region. Germany’s DAX gained 0.1%. France’s CAC 40 rose 0.2%. UK’s FTSE 100 climbed 0.2%. Key Market Drivers 1. ECB Rate Cut Fuels …

Read More »European Stocks Gain as Investors Await ECB Decision and Growth Data

European stock markets advanced on Thursday, as investors evaluated a wave of corporate earnings while anticipating the European Central Bank’s (ECB) policy decision and eurozone growth data. DAX (Germany): +0.2% CAC 40 (France): +0.3% FTSE 100 (UK): +0.1% Key Market Drivers 1. ECB Policy Decision in Focus European equities received …

Read More »Dow Jones may continue its gradual rise 30/1/2025

Oil, Crude, trading

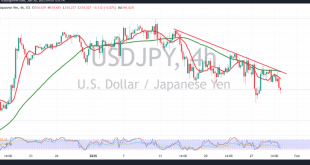

Read More »USD/JPY faces negative pressure 30/1/2025

japanese-yen

Read More »GBP holds above support 30/1/2025

Oil, Crude, trading

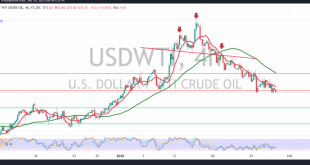

Read More »Oil touches official target 30/1/2025

A bearish trend dominated US crude oil futures, aligning with the previous technical outlook, as the price successfully touched the $72.30 target. Technical Outlook: Simple moving averages continue to pressure prices downward. The price remains below the previously broken support at $73.90, now acting as a resistance level. Key Levels …

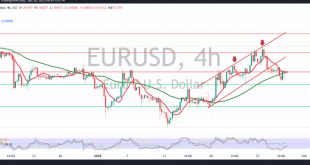

Read More »Euro tends to fall, eyes on ECB 30/1/2025

The EUR/USD pair remained within a narrow sideways range in the previous session, trading above 1.0380 and below 1.0450 without significant movement. Technical Outlook: The pair remains below the key resistance levels of 1.0460 and 1.0485. The Stochastic indicator is positioned near overbought levels, suggesting potential downside pressure. Key Levels …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations