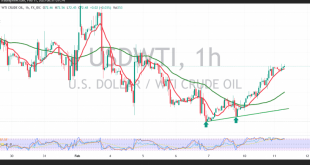

U.S. crude oil futures extended their gains, finding support at $70.90 and reaching a session high of $72.57 per barrel. Technical Outlook: The 4-hour chart shows that simple moving averages are supporting the price from below, offering a positive momentum boost. Oil has stabilized above $72.30, reinforcing the potential for …

Read More »Euro faces negative pressure 11/2/2025

The U.S. dollar pair has shown a slow trend, recording its lowest level at 1.0280 in recent sessions. Technical Outlook: 4-hour chart analysis indicates that there is no significant downside pressure, with only minor bearish signals. The Stochastic Momentum Indicator suggests a potential for improvement in price movement. Key Levels …

Read More »US Dollar and Gold Surge After Trump’s Comments on New Tariffs

The US dollar continued to rise alongside gold, amidst significant market fluctuations triggered by statements made last week by US President Donald Trump. The President hinted at the possibility of imposing new customs tariffs in the coming days.The dollar index, which tracks the performance of the US currency against a …

Read More »European Stocks Edge Higher Despite Trade Uncertainty

European stock markets opened on a positive note Monday, showing resilience despite fresh U.S. trade tariffs. DAX (Germany): Up 0.3% CAC 40 (France): Up 0.1% FTSE 100 (UK): Up 0.1% Key Market Drivers: New U.S. Tariffs and Retaliation Risks President Trump announced 25% tariffs on all steel and aluminum imports, …

Read More »European Stocks Rise as Investors Await BoE Rate Decision and Earnings Reports

European stock markets advanced on Thursday, with investors keeping a close watch on the Bank of England’s (BoE) upcoming rate decision and digesting a wave of corporate earnings reports. Germany’s DAX: +0.8% France’s CAC 40: +0.6% UK’s FTSE 100: +1.2% Bank of England Expected to Cut Rates The BoE is …

Read More »Dow Jones Jumps Higher 6/2/2025

Oil, Crude, trading

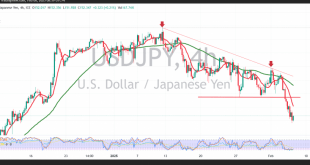

Read More »USD/JPY: Downside pressure persists 6/2/2025

japanese-yen

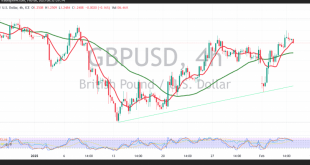

Read More »GBP ahead of USD 6/2/2025

Oil, Crude, trading

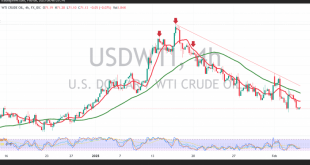

Read More »Oil suffers huge losses 6/2/2025

WTI crude oil continues its losing streak for the third consecutive session, now testing the psychological support at $71.00. Technical Outlook: Moving averages exert downward pressure, reinforcing the bearish bias. Price remains below the previously broken support at 72.40, which has now turned into resistance. Key Levels to Watch: Bearish …

Read More »Euro may resume temporary rise 6/2/2025

The EUR/USD pair experienced a temporary bullish rebound in the previous session, recovering from the psychological support at 1.0200 and reaching a high of 1.0442. Technical Outlook: The Stochastic indicator is attempting to gain bullish momentum, supporting the possibility of further upside. The pair is holding above the previously breached …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations