Oil, Crude, trading

Read More »CAD: needs a directional signal 23/11/2022

Mixed trading dominated the movements of the Canadian dollar within a bearish slant to the downside after finding a solid resistance level of around 1.3460 to end the previous session’s trading at 1.3372. Technically, and by looking closely at the 240-minute chart, we find that the simple moving average started …

Read More »GBP looking for more momentum 23/11/2022

Oil, Crude, trading

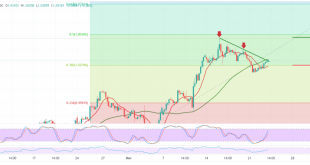

Read More »Oil loses momentum and eyes on inventory data 23/11/2022

We remained neutral during the last analysis due to the high-risk rate and the conflicting technical signals. However, yesterday’s trading session witnessed attempts by oil prices to compensate for the previous losses, recording a high of 82.35. Technically, by looking at the 240-minute chart, we find the stochastic around the …

Read More »Euro: The return of positivity needs confirmation 23/11/2022

A downward trend dominated the movements of the Euro-dollar pair during the previous trading session within the expected downward track mentioned in the last report, approaching by a few points by the first target 1.0210, to suffice for recording its lowest level at 1.0222. Technically, and with a closer look …

Read More »Market Drivers – US Session 22/11/2022

The US dollar plummeted on Tuesday amid the better performance of global equities which closed in the green territory on the back of positive risk appetite Wall Street posted considerable gains, adding the most in the final hours of trading. On the other hand, US Treasury yields edged lower with …

Read More »European stocks rose, driven by the recovery of oil and the rise in mining stocks

European stocks rose on Tuesday, supported by a rebound in commodities stocks after falling in the previous session, as investors searched for mixed signals from European Central Bank policymakers over their stance on interest rates. The pan-European Stoxx 600 index rose 0.2 percent, nearing its highest level in more than …

Read More »Japanese stocks rise, and caution ahead of Fed decision limits gains

Japanese stocks closed higher on Tuesday as the yen’s decline against the dollar boosted expectations of better performance by local manufacturing companies. Still, caution ahead of the Federal Reserve’s monetary policy statement limited gains. The Nikkei index rose 0.61 percent to close at 28,115.74 points, while the broader Topix index …

Read More »Dow Jones tries to hold above support 22/11/2022

Oil, Crude, trading

Read More »CAD: Looking for extra momentum 22/11/2022

Trading tended to be positive, dominating the movements of the Canadian dollar after it confirmed the breach of the resistance level of 1.3350, to end its daily dealings above the mentioned level. Technically, we tend to be positive in our trading, relying on the positive impulse from the 50-day simple …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations