The pair began the week on a bullish note, successfully breaking through the strong resistance level of 1.0450, as highlighted in the previous report. This breakout served as a catalyst for further upside potential, driving the price to a high of 1.0505, with the next target at 1.0540. From a …

Read More »European Markets Rise as Investors Await Inflation Data and ECB Policy Decision

European stock markets opened the week on a positive note, with investors closely monitoring upcoming inflation data from the eurozone ahead of the European Central Bank’s (ECB) policy-setting meeting. As of early trading on Monday, Germany’s DAX index advanced by 0.9%, France’s CAC 40 gained 0.2%, and the UK’s FTSE …

Read More »Dow Jones makes significant gains 3/3/2025

Oil, Crude, trading

Read More »CAD breaks through resistance 3/3/2025

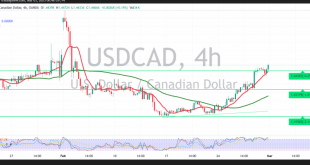

The Canadian dollar surged against the U.S. dollar, posting notable gains after successfully rebounding from the support level at 1.4370, reaching a high of 1.4472. From a technical perspective, the 4-hour chart indicates that the simple moving averages continue to provide support from below, reinforcing the potential for further upside. …

Read More »GBP holds below resistance 3/3/2025

Oil, Crude, trading

Read More »Oil retests resistance 3/3/2025

U.S. crude oil futures attempted to rise, reaching a high of $70.51 per barrel but failed to maintain stability above the key psychological resistance at $70.00. From a technical perspective, the 4-hour chart indicates bearish momentum, as the Relative Strength Index (RSI) remains below the 50 midline, coupled with a …

Read More »Euro breaks support 3/3/2025

The euro experienced a sharp decline against the U.S. dollar at the end of last month’s trading session, reaching a low of 1.0360. From a technical analysis perspective, a closer look at the 4-hour chart reveals that the simple moving averages are negatively intersecting, reinforcing the daily downward price trend. …

Read More »European Markets Decline Amid U.S. Tariff Concerns

European stock markets traded lower on Thursday following U.S. President Donald Trump’s announcement of 25% tariffs on imports from the European Union. At 03:15 ET (08:15 GMT): Germany’s DAX dropped 1%. France’s CAC 40 slipped 0.3%. The UK’s FTSE 100 remained unchanged. Trump, speaking during his first Cabinet meeting on …

Read More »European Markets Decline as Trump Confirms Tariffs on EU Imports

European stocks traded lower on Thursday as markets reacted to U.S. President Donald Trump’s announcement of 25% tariffs on European Union imports, escalating trade tensions between the two economies. Market Performance At 03:15 ET (08:15 GMT): Germany’s DAX fell 1% France’s CAC 40 slipped 0.3% UK’s FTSE 100 remained unchanged …

Read More »European Markets Remain Cautious Amid U.S. Tariff Concerns and Nvidia Earnings

European stocks traded near the flatline on Tuesday, as investors weighed U.S. tariff plans, upcoming earnings from Nvidia (NASDAQ: NVDA), and political developments in Germany. Market Performance (as of 04:08 ET / 09:08 GMT): Stoxx 600: +0.1% to 554.06 FTSE 100 (UK): +0.1% DAX (Germany): -0.1% CAC 40 (France): -0.2% …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations