European stock markets rose on Monday as the region began the new week on a positive note amid encouraging political developments in Germany. At 03:05 ET (08:05 GMT), Germany’s DAX index gained 0.7%, France’s CAC 40 advanced 0.6%, and the UK’s FTSE 100 inched up 0.1%. Political sentiment was boosted …

Read More »European Markets Fall Amid ECB Cuts, Trade Policy Uncertainty, and U.S. Data Concerns

European stock markets sank on Friday as investors digested the latest European Central Bank (ECB) rate reduction ahead of key U.S. employment data, amid persistent uncertainty over U.S. trade policies. At 06:30 ET (11:30 GMT), the pan-European Stoxx 600 dropped 0.5%, Germany’s DAX fell 1.6%, France’s CAC 40 slipped 1.0%, …

Read More »Dow Jones Awaits US Jobs 7/3/2025

Oil, Crude, trading

Read More »CAD gradually loses upward momentum 7/3/2025

The Canadian dollar continues its gradual upward movement, following the expected bullish path from Negative pressure dominated the Canadian dollar’s movement during the previous session. The recent price action—marked by a low of 1.4240—suggests that a break below the support level of 1.4410 could trigger further downside, with a target …

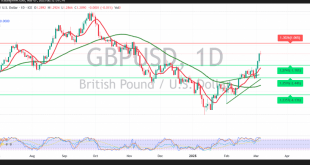

Read More »GBP looks for additional momentum 7/3/2025

Oil, Crude, trading

Read More »Jobs Data Eve: Key NFP Looms Amid Shifting Market Dynamics

NFP Anticipation: Jobs Growth Expected Amidst Economic ShiftsThe US labor market’s health is once again under scrutiny as the February Nonfarm Payrolls (NFP) report approaches. Scheduled for release on Friday, March 7, the data is expected to reveal the creation of approximately 160,000 net new jobs. Economists also anticipate a …

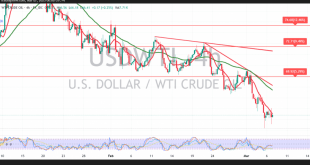

Read More »Oil: Negative pressure continues 7/3/2025

US crude oil futures fell significantly, surpassing the target of 66.20 mentioned in our previous report, and reached a low of $65.62 per barrel. Technical Outlook Bearish Indicators: Prices continue to trade below the simple moving averages, reinforcing the daily downward trend. The break of the 68.20 support level—which has …

Read More »Euro extends gains 7/3/2025

The Euro extended its gains during the previous trading session, surpassing the target of 1.0715 and reaching a high of 1.0853. Technical Outlook Bullish Support: On the 4-hour chart, the simple moving averages continue to support the daily upward trend. Intraday trading remains stable above the resistance level of 1.0715—now …

Read More »European Stocks Present Modest Upside Despite Valuation Concerns

Goldman Sachs strategists have signaled a modest upside for European stocks, even as the market continues to show strong performance forecasts for 2025. In a recent note, Guillaume Jaisson and his colleagues highlighted that while Europe now trades at a forward P/E of 14.2x—slightly above historical averages—it still commands a …

Read More »European Markets Rally on Tariff Compromise Hopes and German Fiscal Boost

European stock markets surged on Wednesday as investors rallied on expectations that a compromise on U.S. trade tariffs may be in the offing, while strong policy moves in Germany to boost defense spending further lifted sentiment. At 06:20 ET (11:20 GMT), Germany’s DAX climbed 3.4%, France’s CAC 40 gained 2%, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations