European stocks rose on Monday as investors assessed the uncertainty surrounding the US debt ceiling talks and the presidential elections in Turkey and were looking forward to data released this week for clues about the state of the global economy. The European Stoxx 600 index rose 0.4 percent, with personal …

Read More »European stocks edge higher, Richemont earnings in focus

European stock markets rose on Friday as investors digested conflicting economic statistics from the United Kingdom as well as additional quarterly corporate reports. At 08:15 GMT, the DAX index in Germany was 0.4% higher, the FTSE 100 in the United Kingdom was 0.3% higher, and the CAC 40 in France …

Read More »Wall Street is grappling with losses related to earnings

U.S. stocks dropped Thursday after disappointing earnings of Disney as well as a plunge in shares of regional banks and the threat of a U.S. debt default. Concerns of bank failure popped up again partially because of debt ceiling potential risk as well as liquidity issues regional banks recently show. …

Read More »Sterling plunges after profit-taking selloff

Sterling pound dropped although the rate hike decision of BoE Thursday because of heavy selling from the part of bulls who focused on profit-taking to benefit from the highs reached immediately after the central bank decision. GBP/USD rose to 1.2610 in response to rate hike decision before declining to 1.2543. …

Read More »Bailey: We are approaching the point of reversing monetary policy

BoE governor Andrew Bailey said “We are approaching the point when we should be able to let level of rates rest” in statements delivered after central bank raised interest rate by 25 basis points. “We have not yet seen evidence that allows us to be sure rates can stay on …

Read More »European stocks rose after falling for two days

European stocks rose on Thursday, led by media and travel stocks, as signs of declining US inflation gave some relief to investors worried about the impact of the Federal Reserve’s tightening monetary policy. The pan-European STOXX 600 index was up 0.5% by 0822 GMT, after two straight days of losses. …

Read More »Most Japanese stocks decline amid mixed earnings

Most Japanese stocks fell on Thursday as investors balked after recent gains and assessed a mixed set of corporate earnings ahead of a high-level meeting of the Group of Seven. Mazda Motor fell 2.69% after the automaker cut sales and profit forecasts due to production restrictions. While Sumitomo Mining shares …

Read More »A slight rise in European stocks ahead of US inflation data

European stocks rose slightly on Wednesday, with Credit Agricole stock rising after posting positive earnings, while investors awaited US inflation data that is likely to set expectations for a rate cut in the world’s largest economy. The pan-European Stoxx 600 index was up 0.1% by 0704 GMT. The US consumer …

Read More »Japan’s Nikkei index is retreating from a 16-month peak amid profit-taking

Japan’s Nikkei index retreated from a 16-month peak on Wednesday as cautious investors looked to book profits ahead of key US inflation data that could influence the Federal Reserve’s path on monetary policy. The results of the business of some companies also cast a shadow on their performance, as the …

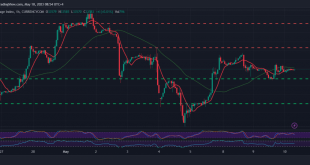

Read More »Dow Jones is looking for more momentum 10/5/2023

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations