Oil, Crude, trading

Read More »CAD continues to decline 15/4/2025

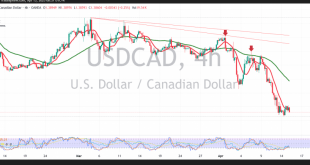

The Canadian dollar remains under sustained downward pressure, with the pair extending its losses over several consecutive sessions and reaching a recent low of 1.3828. From a technical standpoint, the 4-hour chart confirms the continuation of the dominant downtrend. Price action remains firmly below the key simple moving averages, which …

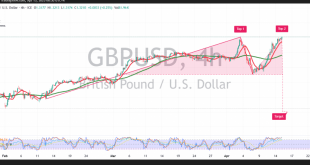

Read More »GBP between correction and trend 15/4/2025

Oil, Crude, trading

Read More »Oil is trying to break through the resistance 15/4/2025

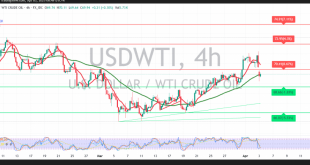

U.S. crude oil futures are experiencing volatility, reversing recent gains and opening the session with a bearish gap. At the time of writing, prices have dipped to a session low of $69.29 per barrel. From a technical perspective, the price has settled below the 50-day simple moving average at $70.90, …

Read More »The Euro benefits from momentum indicators 15/4/2025

The EUR/USD pair remains confined within a narrow sideways range, with a slight bearish bias, after touching a recent low of 1.1296 in the previous session. From a technical standpoint, the 4-hour chart shows the Relative Strength Index (RSI) beginning to ease out of oversold conditions, suggesting a potential shift …

Read More »Market weekly recap: Gold is the king

It was a very busy week in financial markets as US president Donald Trump continues escalation of his trade attacks on a large number of states, which ended in a 90-days pause of tariffs enforcement on all countries, excluding China which was targeted by the maximum duties with “immediate” enforcement. …

Read More »Dow Jones is waiting for a wide price range 3/4/2025

Oil, Crude, trading

Read More »CAD threatens to break support 3/4/2025

The Canadian dollar has pulled back after a streak of gains, encountering strong resistance at 1.4360. This level prompted a reversal, with the pair declining to a session low near 1.4215. From a technical standpoint, the 4-hour chart highlights notable resistance just below the 50-period simple moving average, alongside clear …

Read More »GBP confirms the breakout 3/4/2025

Oil, Crude, trading

Read More »Oil below the moving average 3/4/2025

U.S. crude oil futures are experiencing volatility, reversing recent gains and opening the session with a bearish gap. At the time of writing, prices have dipped to a session low of $69.29 per barrel. From a technical perspective, the price has settled below the 50-day simple moving average at $70.90, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations