Oil, Crude, trading

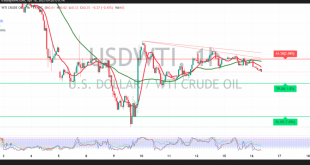

Read More »Oil hovers near support, Eyes potential rebound 15/5/2025

U.S. crude oil futures are currently trading with a bearish tone, following a retreat from the recent high of $63.64 per barrel recorded in the previous session. Technically, the price is attempting to stabilize near the key support level at $61.20, suggesting the possibility of a short-term rebound. This potential …

Read More »Euro weakens as Dollar gains ground 15/5/2025

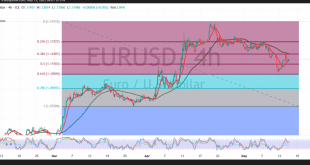

The euro is facing renewed intraday selling pressure as the U.S. dollar attempts to stage a modest rebound. From a technical standpoint, the 4-hour (240-minute) chart shows the pair trading below the 50-period simple moving average, which is acting as strong resistance near the 1.1250 level. Additionally, the Relative Strength …

Read More »Weekly market recap: China dictates market directions

US dollar managed to grasp confidence of investors gradually after positive developments of a potential trade deal between Washington and Beijing throughout last trading week. The possibility to de-escalate trade war between USA and China after increased US president Donald Trump said that the huge tariffs on China could be …

Read More »Dollar Climbs Amid Trade Talk Confusion and Fed Rate Cut Hopes

The US Dollar gained ground on Friday, with the US Dollar Index (DXY) rising 0.37% to hover near 99.65, as markets grappled with conflicting signals on US-China trade negotiations. Optimism sparked by suggestions of ongoing dialogue and potential tariff relief was quickly tempered by China’s firm denial of any active …

Read More »Dow Jones tries to hold above support 16/4/2025

Oil, Crude, trading

Read More »CAD is trending down, all eyes on BoC 16/4/2025

The Canadian dollar remains under sustained downward pressure, with the pair extending its losses over several consecutive sessions and reaching a recent low of 1.3828. From a technical standpoint, the 4-hour chart confirms the continuation of the dominant downtrend. Price action remains firmly below the key simple moving averages, which …

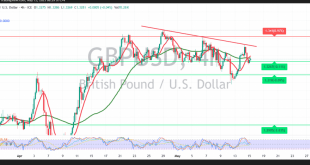

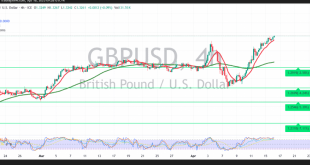

Read More »GBP gains positive momentum 16/4/2025

Oil, Crude, trading

Read More »Oil hits resistance 16/4/2025

U.S. crude oil futures are facing strong resistance near the $61.60 level, which has exerted downward pressure on prices. As a result, oil has retreated and is currently trading around $60.50 per barrel. From a technical perspective, the 50-period simple moving average—hovering near the $61.50 zone—is acting as a firm …

Read More »Euro is trying to find a bottom 16/4/2025

The key support level highlighted in the previous report at 1.1260 successfully halted the recent bearish pressure, triggering a bullish rebound in line with the expected positive scenario. The EUR/USD pair is currently trading around 1.1335. From a technical standpoint, the euro appears to have established a solid base near …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations