Oil, Crude, trading

Read More »Crude Oil Breaches Support Line 22/5/2025

U.S. crude oil futures experienced mixed trading in the previous session after testing the psychological resistance level at $64.00, which effectively halted the upward momentum and capped further gains. Technically, oil is now stabilizing around $61.60. A closer look at the 4-hour chart reveals that the price has broken below …

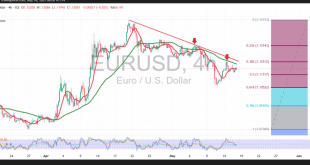

Read More »Euro Eyes a Potential Break Above Resistance 22/5/2025

The euro advanced against the U.S. dollar in the previous trading session, reaching a session high of 1.1362. From a technical analysis perspective, the 4-hour (240-minute) chart shows that the EUR/USD pair has successfully consolidated above the previously breached resistance at 1.1255, now acting as support in accordance with the …

Read More »Dow Jones Shows Signs of Recovery 16/5/2025

Oil, Crude, trading

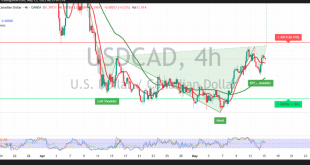

Read More »CAD Needs a Positive Catalyst 16/5/2025

The Canadian dollar has resumed an upward corrective trend after establishing a solid support base The Canadian dollar met its initial upside target at 1.4000, with the pair registering a session high of 1.4004 during the previous trading session. From a technical perspective, the 1.4000 psychological resistance level has exerted …

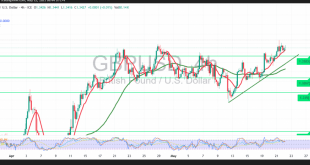

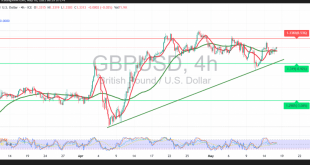

Read More »GBP Attempts a Gradual Recovery 16/5/2025

Oil, Crude, trading

Read More »Oil Traders Should Monitor Price Behavior Closely 16/5/2025

U.S. crude oil futures aligned with the expected upward movement in the previous session, as the price held above the pivotal $61.20 support level. Although the market briefly dipped to $60.11, triggering a pullback that offset earlier long positions, the broader technical structure remains constructive. On the 4-hour chart, the …

Read More »Euro Trades Within a Sideways Range 16/5/2025

The EUR/USD pair traded within a narrow sideways range during the previous session, with limited attempts to generate short-term gains amid subdued momentum. From a technical perspective, the 4-hour (240-minute) chart shows the pair continuing to trade below the 50-period simple moving average, which is acting as a firm resistance …

Read More »Dow Jones struggles to hold above Key support 15/5/2025

Oil, Crude, trading

Read More »CAD starts positively 15/5/2025

The Canadian dollar has resumed an upward corrective trend after establishing a solid support base around the psychological level of 1.3900. From a technical standpoint, the 4-hour chart indicates that bullish momentum is gaining traction. The pair is now supported by upward-sloping simple moving averages, which are once again acting …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations