European stocks rose to their highest level in nearly two weeks on Wednesday, supported by health care stocks, as investors awaited a widely expected decision from the Federal Reserve to keep interest rates unchanged later on Wednesday. The European STOXX 600 index rose 0.1 percent by 0825 GMT, heading for …

Read More »Nasdaq Demands Attentive Monitoring 1/11/2023

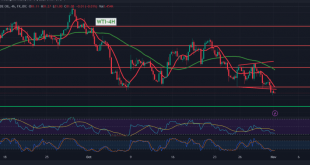

Oil, Crude, trading

Read More »Dow Jones recovers ahead of Fed decision 1/11/2023

Oil, Crude, trading

Read More »CAD achieves the first goal 1/11/2023

During the previous trading session, the Canadian dollar successfully reached the initial target set at 1.3875, reaching its highest point at 1.3892. From a technical perspective, our analysis leans toward optimism. The 50-day simple moving average continues to support the potential for an upward movement. Additionally, intraday trading stability above …

Read More »USD/JPY achieve record gains 1/11/2023

japanese-yen

Read More »GBP: negative pressure still intact 1/11/2023

Oil, Crude, trading

Read More »Oil continues to suffer losses 1/11/2023

US crude oil futures prices have sustained losses as anticipated in the previous report, reaching the initial target of $81.15 and touching a low of $80.80 per barrel. Upon analysis of the 240-minute timeframe, the trading remains stable below $82.00 and, more broadly, under the resistance level of $82.70. This …

Read More »Euro Hit resistance 1/11/2023

Positive momentum influenced the Euro/Dollar pair’s movements briefly, causing a temporary deviation from the anticipated downward trend. This deviation occurred after the pair consolidated above 1.0600 temporarily, leading to a recovery toward 1.0640 and 1.0670, reaching a peak at 1.0674. From a technical perspective, the resistance level at 1.0670 exerted …

Read More »European stocks rise supported by real estate and BP is hurting the energy sector

European shares rose on Tuesday, led by real estate and chemicals shares, as investors weighed a batch of economic data, while BP’s weak third-quarter earnings weighed on the energy sector. By 0826 GMT, the European STOXX 600 index rose 0.2 percent, but was heading for its worst monthly performance since …

Read More »Nasdaq: Negative pressure exists 31/10/2023

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations