US Data released on Friday showed the Employment Cost Index (ECI) rose 1% during the fourth quarter, and 4% during the year. Analysts at Wells Fargo point out the quarterly increase was more restrained than Q3’s 1.3% gain, and they consider that may tamp down fears of a wage-price spiral …

Read More »How Latest Geopolitical Tensions Impacted Financial Markets

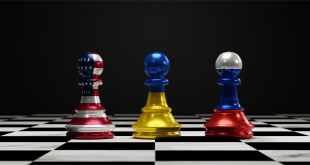

Tensions are escalating in Eastern Europe as several reports refer to potential invasion of Ukraine. The crisis brought about several important developments that, in effect, throw heavy shadows on the financial markets, and, in turn, impact price movements as well as igniting concerns on oil supply disruption.The new developments include …

Read More »Oil falls 2% as Fed rate hike talk ghosts risk markets

At the time of writing, WTI picks up bids towards $84.00, extending the late Monday’s recovery during the initial Asian session on Tuesday. The oil benchmark’s latest recovery takes clues from a bullish Doji candlestick and Momentum line. Oil prices fell about 2% on Monday, hit by investor concerns over …

Read More »Baker Hughes: US oil rig count falls for first time in 13 weeks

US energy firms this week cut oil rigs for the first time in 13 weeks after crude prices fell for six weeks in a row from late October-early December. Oil prices, meanwhile, have recovered and traded at their highest since 2014 this week. Energy analysts said it usually takes about …

Read More »USD/CAD Impacted By Higher Oil Prices, Hawkish BoC

USD/CAD has had a passive session on Tuesday, with the pair dropping back to trading just above its 200-day moving average at the 1.2500 level after briefly surpassing the 1.2550 mark midway through US trade. Surging crude oil prices that saw front-month WTI futures hit multi-year highs near the $86.00 …

Read More »Meet Mohamed Hashad on Dubai TV 01/17/2022

Director of Research and Development at Noor Capital and member of the US Association of Professional Technical Analysts, Mohamed Hashad, was interviewed Monday morning by Dubai Channel to comment on the most outstanding developments in the financial markets during the second week of 2022, as oil continued to reap gains …

Read More »Crude Oil Edges Lower On Profit-Taking, Rate Hike Concerns

Crude oil prices edged lower on Thursday as investors took profits after two days of gains amid fears of aggressive US interest rate hikes.Losses were cushioned by expectations of a strong economic recovery that will boost demand in a tightly supplied market. US West Texas Intermediate crude futures settled down …

Read More »Oil Retreated From Its Highest Level Since Omicron

The statements of US Federal Reserve Chairman Jerome Powell came with a state of concern in the markets about the lack of supply resulting from the current events in Libya and Kazakhstan, giving a solid boost for oil prices. Powell stressed that the fed uses all tools to manage the …

Read More »Crude Oil Retreats From Session Highs As US Shares Drop

WTI crude oil has pulled back from session highs above $80.00 as US equities came under selling pressure at the opening of the North American session.Crude oil is expected to continue to perform better than equities, which are suffering from the Fed’s hawkish policy, if the demand outlook remains strong.Amid …

Read More »Crude Oil Falls On Easing Supply Disruptions

Oil prices weakened Monday as supply problems in Kazakhstan and Libya eased, while concerns grew about the rapid rise of Omicron cases in China, the second largest economy in the world. West Texas Intermediate, the benchmark for US crude, settled down by 67 cents, or 0.9%, at $78.24 per barrel. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations