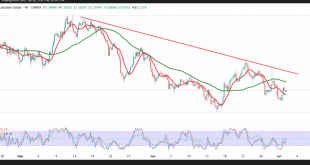

The Canadian dollar pulled back in the previous session after several days of gains, with the pair reaching a recent high of 1.3734 before entering a corrective phase. Technical Outlook – 4-Hour Timeframe: Intraday technical activity shows a break of an ascending trendline, which triggered some short-term bearish movement. The …

Read More »CAD Trades Above Key Support: Are Further Gains Likely? 18/7/2025

The Canadian dollar continued its upward trajectory, achieving the expected positive targets outlined in the previous technical report. The pair reached the 1.3770 target and extended to a new high of 1.3774. Technical Outlook – 4-Hour Timeframe: Price action reflects ongoing bullish momentum, supported by the pair’s stability above the …

Read More »CAD Edges Higher in a Calm Upward Move 16/7/2025

The USD/CAD pair continued its steady upward movement, in line with the expected bullish trend, approaching the previously identified technical target at 1.3740 after reaching a session high of 1.3730. Technical Outlook – 4-Hour Timeframe: The 50-period Simple Moving Average (SMA) continues to provide dynamic support, reinforcing the pair’s bullish …

Read More »CAD Maintains Bullish Technical Momentum 15/7/2025

The pair continues to benefit from the support of the 50-period Simple Moving Average (SMA), which reinforces short-term bullish momentum. This is further supported by a notable improvement in momentum indicators, with the Relative Strength Index (RSI) generating constructive signals that favor the continuation of the uptrend in the near …

Read More »CAD Tests Key Psychological Level Amid Bullish Momentum 11/7/2025

The USD/CAD pair has continued to move higher, in line with the bullish outlook outlined in the previous technical report, reaching the target at 1.3730 during recent trading. Technical Outlook – 4-Hour Timeframe: The pair remains supported by the 50-period Simple Moving Average (SMA), which reinforces the current bullish momentum. …

Read More »CAD Challenges Resistance as Bullish Momentum Builds 9/7/2025

The Canadian dollar pair defied the bearish expectations outlined in our previous report. The negative scenario had depended on sustained trading below the key resistance level at 1.3685. However, the pair managed to stage a short-term bullish technical rebound, invalidating the earlier downside bias. Technical Outlook – 4-Hour Timeframe: The …

Read More »CAD Holds on to Support Amid Weak Momentum 8/7/2025

During yesterday’s trading, the Canadian dollar faced strong resistance near 1.3685, which effectively capped the upside and pressured the pair lower. At the time of writing, USD/CAD is trading around 1.3655, remaining under the influence of that resistance zone. Technical Indicators The simple moving averages are acting as dynamic resistance, …

Read More »CAD Resists Further Decline but Remains in a Bearish Trend 2/7/2025

The USD/CAD pair recorded modest gains during today’s session as it attempted to recover from recent losses, showing cautious bullish momentum in intraday trading. Technical Outlook – 4-hour Chart:Despite the slight rebound, the pair remains under pressure from the simple moving averages acting as dynamic resistance. Additionally, the Relative Strength …

Read More »CAD Struggles to Maintain Upbeat Momentum in a Cautious Market 26/6/2025

The USD/CAD pair exhibited cautious bullish behavior yesterday, aligning with the expected upward scenario and reaching a high near the key resistance level of 1.3760. From a technical standpoint today, the 240-minute chart reveals continued support from the simple moving averages, which are reinforcing the bullish sentiment. Additionally, the Relative …

Read More »CAD Holds on to Its Bullish Sentiment 25/6/2025

The USD/CAD pair received a positive boost during the previous trading session, successfully recording its highest level near the 1.3740 resistance level. From a technical analysis perspective today, and by examining the 240-minute chart, we find that the simple moving averages are still supporting the price from above, providing positive …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations