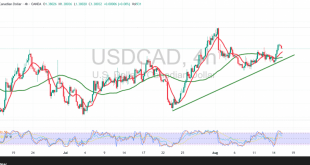

An upward trend took hold of the USD/CAD pair after several sessions of sideways movement, with the pair reaching its highest level in the previous session at 1.3820. Technical Outlook – 4-hour timeframe: Following yesterday’s rise, intraday price action is showing a natural pullback, yet the pair remains firmly above …

Read More »CAD Caught Between Support and Resistance Battle 13/8/2025

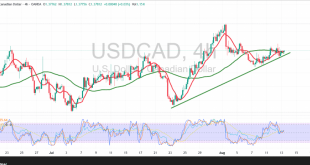

The USD/CAD pair is trading within a narrow sideways range, supported at 1.3750 and capped by resistance just below 1.3800. Technical Outlook – 4-hour timeframe: Technical indicators point to a possible resumption of the uptrend, backed by the 50-period simple moving average, which continues to provide support. However, early signs …

Read More »CAD Holds Steady Amid Unchanged Technical Setup 8/8/2025

Mixed price action characterized the USD/CAD pair during the previous trading session, as the pair tested the 1.3770 resistance level, which effectively capped the weak bullish attempts. Technical Outlook: Current technical indicators suggest a potential resumption of the broader downtrend. This is reinforced by continued pressure from the 50-period Simple …

Read More »Canadian Dollar Breaks the Uptrend Line 7/8/2025

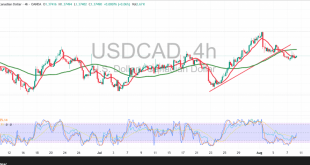

In our previous report, we maintained a neutral stance due to conflicting market signals. However, a clear bearish development has since occurred, as the support level at 1.3760 was broken, potentially triggered by early-session momentum at 1.3720. The pair has since recorded its lowest level of the session at 1.3729. …

Read More »Technical Pressures Constrain USD/CAD Within a Tight Range 6/8/2025

The USD/CAD pair is currently trading within a narrow range, consolidating between the psychological resistance at 1.3800 and the support level at 1.3760. Technical Outlook: Technical indicators are showing mixed signals. The Relative Strength Index (RSI) is gradually losing upward momentum, reflecting weakening bullish pressure. At the same time, the …

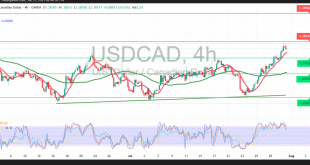

Read More »Canadian Dollar Seeks Additional Momentum 1/8/2025

The technical outlook remains unchanged, as the USD/CAD pair continues to respect the prevailing uptrend highlighted in our previous report. The pair recorded a session high near the key resistance zone at 1.3870, reflecting ongoing bullish momentum. Technical Outlook: Intraday movements remain bullish, supported by continued price stability above the …

Read More »Canadian Dollar Continues Its Gradual Rise 31/7/2025

The USD/CAD pair continued to follow the bullish outlook highlighted in our previous report, successfully reaching the official target of 1.3840 and recording a session high of 1.3845. Technical Outlook: The pair maintains a strong upward trajectory, supported by continued price stability above key Simple Moving Averages (SMAs), which act …

Read More »Canadian Dollar Receives Positive Signals 30/7/2025

The USD/CAD pair confirmed the bullish outlook outlined in our previous report, reaching the initial target at 1.3780 and registering a session high of 1.3788. Technical Outlook: Intraday price action continues to reflect a strong bullish trend, supported by sustained stability above the key Simple Moving Averages (SMAs), which serve …

Read More »Canadian Dollar in a Bullish Technical Rebound 29/7/2025

A short-term bullish trend has re-emerged in the USD/CAD pair, supported by stability above the key psychological support level of 1.3700. Technical Outlook: Intraday price action reflects a bullish bias, reinforced by the pair’s position above key Simple Moving Averages (SMAs), which continue to provide dynamic support. Additionally, the Relative …

Read More »Canadian Dollar’s Upward Momentum Loses Steam 23/7/2025

The USD/CAD pair came under renewed bearish pressure after failing to maintain stability above the 1.3670 level. This failure reversed the previously expected bullish scenario, with the pair falling to a session low of 1.3595. Technical Outlook – 4-Hour Timeframe: Short-term technical movements confirm a break below the ascending trendline, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations