The USD/CAD pair is consolidating near the psychological resistance at 1.3800, but has yet to achieve a decisive breakout. Technical Outlook – 4-hour timeframe: The 1.3800 level remains a firm resistance zone on short-term charts, while the Relative Strength Index (RSI) is beginning to issue negative signals, reflecting waning momentum …

Read More »Canadian Dollar Retests Support 8/9/2025

The USD/CAD pair is moving with a bearish bias after retreating from the 1.3850 resistance level, which capped previous highs and pressured the pair into a short-term downtrend. Technical Outlook – 4-hour timeframe: Support is emerging near the 1.3800 level on short-term charts. However, the Relative Strength Index (RSI) has …

Read More »CAD Stops Its Downward Corrective Trend 3/9/2025

The downward corrective trend highlighted in the previous report has paused, with the USD/CAD pair beginning the day’s trading on strong footing, posting notable gains. Technical Outlook – 4-hour timeframe: The pair is currently testing the psychological resistance at 1.3800. Simple moving averages have shifted back to support the price …

Read More »CAD Within a Bearish Correction Path 2/9/2025

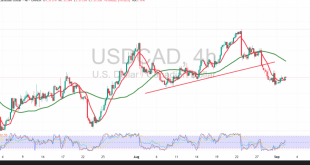

A bearish corrective trend continues to dominate the USD/CAD pair after failing to sustain gains above the psychological barrier of 1.3800. Technical Outlook – 4-hour timeframe: The pair has broken below the ascending support line, as shown on the chart, alongside the continuation of a negative crossover in the simple …

Read More »CAD Confirms the Breakout 28/8/2025

The USD/CAD pair declined in the previous trading session. As highlighted in our last report, we maintained a neutral stance due to conflicting technical signals, noting that a break below 1.3820 would apply negative pressure and open the way for a retest of 1.3790. The pair indeed extended losses, reaching …

Read More »CAD Stands by for a More Decisive Trend 27/8/2025

The technical outlook remains unchanged, with the USD/CAD pair continuing to trade in a sideways range as conflicting technical signals persist. Technical Outlook – 4-hour timeframe: The 50-period simple moving average is pressing down on the price from above, creating a resistance level that may limit upward attempts. At the …

Read More »Canadian Dollar Between Trend and Correction 26/8/2025

The USD/CAD pair recovered gradually from previous session losses, posting a bullish rebound that lifted the pair to a high of 1.3865. Technical Outlook – 4-hour timeframe: The 50-period simple moving average continues to support the potential for a bullish daily price path, reinforced by the pair’s stability above the …

Read More »The Bullish Scenario Dominates the Loonie’s Movements 22-8-2025

The USD/CAD pair has been gradually rising, following the expected positive outlook. It touched the first technical station at 1.3920 after reaching its highest level during the current session’s early trading at 1.3915. Technical Outlook – 4-Hour Timeframe The pair successfully broke the resistance level of 1.3880, which has now …

Read More »Canadian Dollar Tests Resistance Strength – 21/08/2025

The technical outlook remains unchanged, with the upward trend continuing to dominate the movements of the USD/CAD pair. This comes after repeated closes above the pivotal 1.3800 support level, which has reinforced the pair’s positive outlook. Technical Outlook – 4-Hour Timeframe The pair is currently facing a strong resistance level …

Read More »Canadian Dollar: Between Correction and Uptrend 20/08/2025

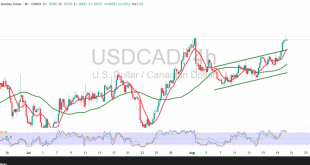

The USD/CAD pair has been dominated by an upward trend after recording repeated closes above the pivotal support level of 1.3800, which reinforces the pair’s positive outlook. Technical Outlook – 4-Hour Timeframe The pair is currently facing a strong resistance level around 1.3880. The Relative Strength Index (RSI) is clearly …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations