On early Thursday, dollar bulls tested the USD/JPY market, but their excitement quickly faded. This cautious attitude reflects the nervousness of investors as they anxiously await the Bank of Japan’s policy announcement. The US Federal Reserve’s hawkish turn eclipsed the less-than-expected US inflation numbers, giving the dollar a little boost.Due …

Read More »Market Drivers; US Session, June 12

Recent economic news and headlines have been dominated by data and concerns related to US inflation. The negative surprise of the US CPI in May caused the US dollar to rapidly revert its recent positive trend, although the hawkish stance taken by the Federal Reserve helped the USD Index (DXY) …

Read More »Financial Markets’ Weekly Recap: Fed Policy, Market Sentiment, Jobs Data

The financial markets displayed a mixed performance this past week, as investors navigated a confluence of economic data, central bank policy updates, and ongoing geopolitical tensions. While some sectors thrived, others took a backseat, reflecting the underlying uncertainty about the future trajectory of the global economy. Equity Markets Take a …

Read More »Rumours drag USD/JPY lower

USD/JPY has fallen to 155.00 due to a combination of risk-off market sentiment and rumors that the Bank of Japan (BoJ) is considering reducing bond purchases at its June meeting. This move would raise Japanese bond yields and support the Yen, a negative for USD/JPY. The US Dollar (USD) bounced …

Read More »Rate differential between Eurozone, Japan boosts EUR/JPY

EUR/JPY continues to rise, up 0.23% at the time of writing, due to a wide interest-rate differential between the Eurozone and Japan, which favours the Euro over the Japanese Yen. The absence of direct intervention by Japanese authorities to strengthen the Yen in early May has led to the pair …

Read More »Noor Capital | Interview with Mohammad Hashad on Dubai TV – May 20

Mohammed Hashad, Head of Research and Development at Noor Capital and a distinguished member of the US Association of Technical Analysts, provided insightful commentary and thorough analysis on the latest market dynamics and key asset performances in an exclusive interview with Dubai TV. Firstly, the markets are anticipating the Federal …

Read More »Japan’s Suzuki: Appropriate actions will be taken on Foreign Exchange if needed

Shunichi Suzuki, the finance minister of Japan, stated on Friday that he will be closely monitoring the foreign currency (FX) move and that, if necessary, he will take the appropriate action. The Japanese Yen (JPY) shows little to no market reaction to the verbal intervention. As of this writing, the …

Read More »USD/JPY rises towards 156.00.

This week’s US economic data schedule is somewhat low; up to Friday’s University of Michigan Consumer Sentiment Index, the only available data is of a moderate quality. In May, the UoM’s indexed poll of consumer economic expectations is predicted to decline slightly from 77.2 to 76.0 MoM. In March, the …

Read More »Noor Capital | Interview with Mohammad Hashad on Dubai TV – May 6

“Mohammed Hashad, Head of Research and Development at Noor Capital and a distinguished member of the US Association of Technical Analysts, provided insightful commentary and thorough analysis on the latest market dynamics and key asset performances in an exclusive interview with Dubai TV.” Interest Rate Decision of the Bank of …

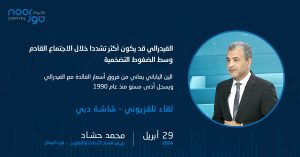

Read More »Noor Capital | Interview with Mohammad Hashad on Dubai TV – April 29

Mohammed Hashad, Head of Research and Development at Noor Capital and member of the US Association of Technical Analysts, commented and analyzed the most prominent market developments and the performance of the most important assets, in an interview on Dubai TV. US Interest Expectations, Federal Reserve Decisions:Asked about his expectations …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations