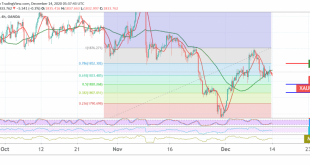

Trading tended to be negative during the last trading session last week, when gold prices touched the first target to be achieved, 1825, recording its lowest level at 1823. Technically, despite the return of stability above the support floor of 1823, we find negative signs still dominating the stochastic, accompanied …

Read More »The Euro is Looking For a More Powerful Trend

The euro’s movements against the US dollar witnessed a slight bullish tendency, benefiting from stability above the support level of 1.2070, as the current moves in the pair witness a re-test of the 1.2170 resistance level. On the technical side, we find the 50-day moving average that holds the price …

Read More »German Dax Maintains Positive Stability

The German DAX maintains positive stability after succeeding in establishing a decent support floor above 13,220 and generally above 13,190. On the technical side, we tend to be positive in our trading, relying on the index’s anchorage above the 13,220 support floor, which is accompanied by the positive stimulus of …

Read More »Dow Jones Re-testing Support

The Dow Jones Industrial Average found a strong resistance level around 30,160, which was able to limit the upside temporarily, as the current moves are witnessing a slight bearish slope around its lowest level during the session 29,950. On the technical side, and with a closer look at the 60-minute …

Read More »GBP/JPY Retest Resistance

Negative trading dominated the pound’s movements against the Japanese Yen, as we expected, touching the target to be achieved mentioned in the previous analysis, at 138.10, recording 138.20, its lowest price during the previous session. On the technical side, today the current moves are witnessing a slight upward slope, as …

Read More »CAD Touches Target of The Downward Wave

The Canadian dollar declined significantly, heading to visit our first target for the current downturn, which was published in all technical reports for the current week at a price of 1.2700, recording a low at 1.2705. On the technical side, and by looking at the 60-minute chart, we find the …

Read More »Pound Continues to Decline Against US Dollar

Strong declines in the movement of the pound against the US dollar approached by a few points from the first target of the current wave of decline, as we expected at 1.3220, recording a low at 1.3242. On the technical side, and with a closer look at the 4-hour chart, …

Read More »Oil Achieves Upside Targets

Oil, Crude, trading

Read More »Gold Keeps The Bearish Path

The technical outlook remains unchanged, and gold’s movements have not changed significantly, maintaining the bearish bias, stable below the 1850 resistance level. Technically speaking, and with a closer look at the 240-minute chart, the signs of negativity are still dominating the stochastic, and this comes in conjunction with the RSI …

Read More »Euro Re-test Resistance

The euro’s movements against the US dollar witnessed a slight bullish tendency, benefiting from stability above the support level of 1.2070, as the current moves in the pair witness a re-test of the 1.2170 resistance level. On the technical side, we find the 50-day moving average that holds the price …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations