The German DAX index succeeded in touching the official station to be achieved, which is located at 13,580, recording its highest level of 13,587. On the technical side, the index is successful in building a base on the 13,500/13,490 support floor, temporarily supporting the upside, in addition to the positive …

Read More »Dow Jones Settled Above Support

Positive moves dominate the Dow Jones Industrial Average on Wall Street, recording a high of 30,225. On the technical side, we tend to be positive in our trading, but cautiously depending on the index’s price base above the 30,000/29,990 support level, accompanied by the persistence of stochastic centring around overbought …

Read More »GBP/JPY Looking For Stronger Direction

The British pound sterling achieved noticeable gains against its US counterpart during the previous trading session, touching our first awaited target at 139.90, recording its highest level during the last session at 140.07. On the technical side, and with a closer look at the 4-hour chart, we find negative signs …

Read More »CAD Gradually Losing Ground

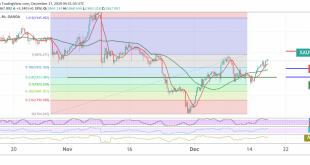

The Canadian dollar was able to achieve the technique of retesting the resistance published during the previous analysis, which we made clear yesterday that we will increase the risk appetite to target 1.2775, recording the highest of 1.2790. Technically speaking, signs of negativity began to appear on Stochastic again and …

Read More »Pound Outperforms Against US Dollar

Oil, Crude, trading

Read More »Oil Flirts With $50.0

Oil, Crude, trading

Read More »Gold Hovering Around Pivotal Resistance

Mixed trades dominated gold prices, but trading tended to be positive, heading to touch the first target expected to be achieved during the previous analysis, located at the price of 1867, its highest level during the morning trading of the current session 1868. On the technical side, we find gold …

Read More »Euro Breaks Through Resistance

After several sessions in a row, we waited to confirm the breach of the resistance level at 1.2175, explaining that the breach of it is a catalyst that strengthens the chances of the upside to visit the awaited target of 1.2225, to record the euro at its highest level during …

Read More »Germany’s DAX Maintains Its Gains

Positive trading dominated the German DAX index, surpassing the required target at 13380, posting a high at 13427. On the technical side, the price has stabilized above 13,265, accompanied by positive signs of the RSI. It encourages us to maintain our positive outlook, provided that the breach of 13,430 is …

Read More »Dow Jones Settled Above Support

slight Positive Trades dominated the Dow Jones Industrial Average after it managed to build on the support level of 30,000, approaching the required target of 30,260, recording the highest of 30,240. On the technical side, the RSI indicator is still defending the upside, and this comes in conjunction with the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations