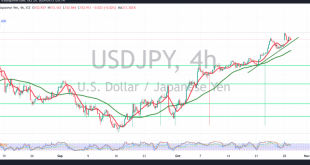

japanese-yen

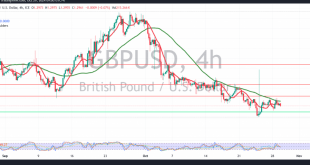

Read More »GBP continues to decline 31/10/2024

Oil, Crude, trading

Read More »Oil is trying positively 31/10/2024

US crude oil futures saw a positive rebound, recovering from a low of $67.31 per barrel in the previous session. Technical Analysis: Breaching the resistance level of $68.60 has provided support for further gains. The 240-minute chart also shows the Relative Strength Index gaining positive signals, reinforcing the upward outlook. …

Read More »Gold to be monitored closely 31/10/2024

Gold prices have continued their historic climb, reaching $2790 per ounce after surpassing the previous peak of $2758. Technical Analysis: The 4-hour chart shows that simple moving averages continue to support the upward momentum, while the momentum indicator remains strong above the 50 midline, indicating a sustained bullish outlook. For …

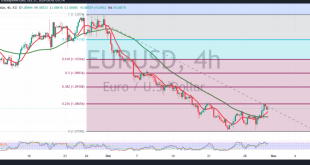

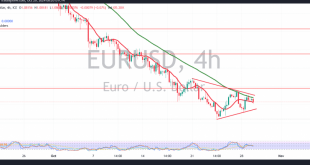

Read More »Euro holds steady below resistance 31/10/2024

The EUR/USD pair has reaffirmed its 1.0865 resistance level but failed to break through it in the last session. Technical Analysis: A closer look at the 4-hour chart shows that the 50-day simple moving average supports a potential decline, with the stochastic indicator gradually losing upward momentum. While technical indicators …

Read More »Dow Jones tries to recover 29/10/2024

Oil, Crude, trading

Read More »USDJPY trying positively 29/10/2024

japanese-yen

Read More »GBP faces negative pressure 29/10/2024

Oil, Crude, trading

Read More »Gold records lower highs 29/10/2024

Gold prices are currently showing positive momentum as they attempt to breach the recent peak of $2758 per ounce. Technical Analysis: Analyzing the 4-hour chart, gold has started forming lower peaks, suggesting a potential continuation of a downward correction. The Stochastic indicator is also providing negative signals, indicating a possibility …

Read More »Euro awaits confirmation of break 29/10/2024

The EUR/USD pair has been trading sideways, attempting to hold above the support level of 1.0760. However, positive movement has been limited, with the pair struggling to rise above the main resistance at 1.0850. Technical Analysis: On the 240-minute chart, the 50-day simple moving average indicates potential for further decline, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations