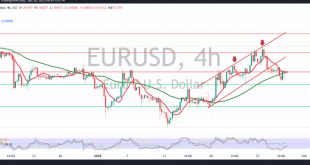

The EUR/USD pair experienced a temporary bullish rebound in the previous session, recovering from the psychological support at 1.0200 and reaching a high of 1.0442. Technical Outlook: The Stochastic indicator is attempting to gain bullish momentum, supporting the possibility of further upside. The pair is holding above the previously breached …

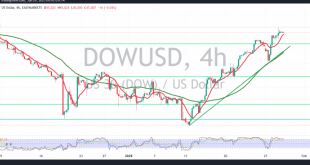

Read More »Dow Jones may continue its gradual rise 30/1/2025

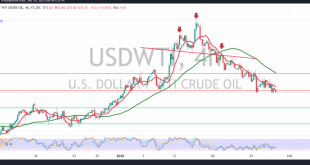

Oil, Crude, trading

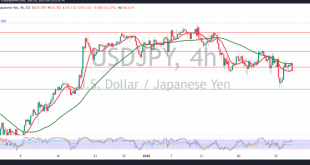

Read More »USD/JPY faces negative pressure 30/1/2025

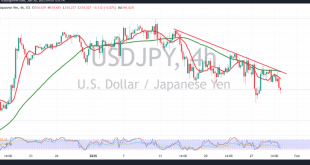

japanese-yen

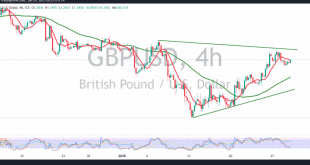

Read More »GBP holds above support 30/1/2025

Oil, Crude, trading

Read More »Oil touches official target 30/1/2025

A bearish trend dominated US crude oil futures, aligning with the previous technical outlook, as the price successfully touched the $72.30 target. Technical Outlook: Simple moving averages continue to pressure prices downward. The price remains below the previously broken support at $73.90, now acting as a resistance level. Key Levels …

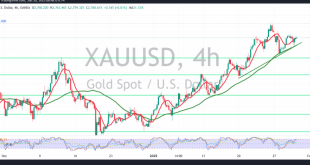

Read More »Gold is based on support 30/1/2025

Gold managed to establish strong support above $2740, rebounding higher in the previous session and reaching $2766 per ounce. Technical Outlook: The price remains above the 50-day simple moving average, reinforcing bullish momentum. The Stochastic indicator shows positive signals, suggesting further upside potential. Key Levels to Watch: Above $2770: A …

Read More »Euro tends to fall, eyes on ECB 30/1/2025

The EUR/USD pair remained within a narrow sideways range in the previous session, trading above 1.0380 and below 1.0450 without significant movement. Technical Outlook: The pair remains below the key resistance levels of 1.0460 and 1.0485. The Stochastic indicator is positioned near overbought levels, suggesting potential downside pressure. Key Levels …

Read More »Dow Jones touches desired target 29/1/2025

Oil, Crude, trading

Read More »USD/JPY: Waiting for a Move Signal 29/1/2025

japanese-yen

Read More »GBP tests support 29/1/2025

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations