Narrow sideways trading tended to the negativity that dominated gold’s movements during the previous session, under pressure from the rise of the US dollar, reaching the lowest of 1654, after it failed to cross upwards to the resistance level of 1670. Technically, the 50-day simple moving average is trying to …

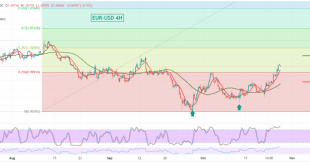

Read More »Euro presses support amid conflicting technical signals 28/10/2022

The single European currency reversed the bullish trend despite the European Central Bank raising interest rates by 75 basis points to return to stability below 1.0000. On the technical side, we find the 50-day simple moving average still carrying the price from below, supporting the possibility of a rise. On …

Read More »Dow Jones maintains a positive consistency 26/10/2022

Oil, Crude, trading

Read More »CAD continues to descend towards the goals 27/10/2022

The Canadian dollar achieved the negative targets required during the previous technical report to reach the first target at 1.3545, approaching by a few points from the second target of 1.3495, recording the lowest level at 1.3505. Technically and carefully considering the 4-hour chart, we find the simple moving averages …

Read More »GBP continues to gain 27/10/2022

Oil, Crude, trading

Read More »Oil breaks through resistance and rises cautiously 27/10/2022

US crude oil futures prices reversed the expected bearish trend during the latest analysis after the report issued by the International Energy Agency on oil inventories, recording extended gains around $88.47 per barrel. Technically, today, the current moves are witnessing stability above the previously breached resistance level, which is now …

Read More »Gold needs extra momentum to continue rising 27/10/2022

We remained neutral during the previous session’s trading, explaining that we are waiting for the activation of the pending orders due to the conflicting technical signals at the time of the report’s release, explaining that activating the buying positions depends on confirming the breach of 1666 to target 1677, recording …

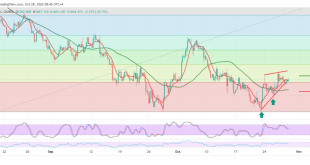

Read More »Euro touches the goals, Eyes on ECB 27/10/2022

An upward trend dominated the euro’s movements against the US dollar yesterday, within the expected positive outlook during the previous analysis, touching the official target station at 1.0050, recording the highest level at 1.0093. Technically, the simple moving averages continue to support the daily bullish curve for prices and the …

Read More »Dow Jones extends gains 26/10/2022

Oil, Crude, trading

Read More »CAD may see further declines ahead of the BoC decision 26/10/2022

The Canadian dollar is trading with noticeable negativity after it failed to maintain positive stability above the 1.3655 support level, to witness the current movements of the pair stabilizing around its lowest level during the early trading of the current session, around 1.3595. Technically, we tend in our trading to …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations