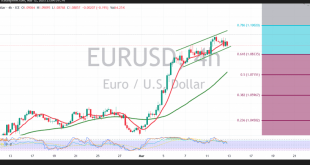

The EUR/USD pair successfully reached the first target outlined in the previous technical report at 1.0940, recording a high of 1.0945. Technical Analysis Looking at the 4-hour chart, the pair has established strong support at 1.0830, corresponding to the 61.80% Fibonacci retracement level. Additionally, the Stochastic indicator continues to gain …

Read More »Dow Jones extends losses 11/3/2025

Oil, Crude, trading

Read More »CAD is recovering 11/3/2025

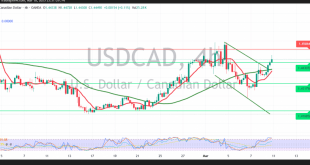

The bullish trend has regained control of the Canadian dollar, halting the bearish corrective move noted in our previous report after establishing support near 1.4350. On the 4‑hour chart, the pair has moved above its simple moving averages, and the 14‑day momentum indicator is now showing positive signals. With these …

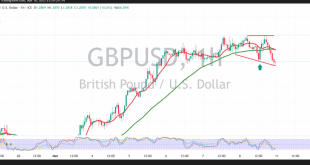

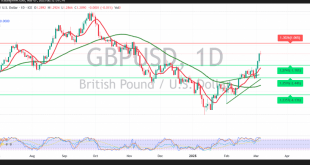

Read More »GBP tries to gain extra momentum 11/3/2025

Oil, Crude, trading

Read More »Oil continues to decline 11/3/2025

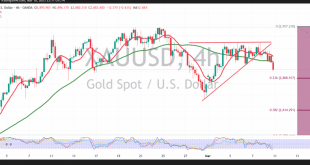

US crude oil futures continue their downward trend, reaching the official target of 65.75 from our previous report and recording a low of $65.80 at the time of writing. On the technical side, prices remain below the simple moving averages that support the daily downtrend, and the break of the …

Read More »Gold presses support 11/3/2025

During yesterday’s European session, gold traded sideways, confined by the psychological support at 2900 and a pivotal resistance at 2930. On the 4‑hour chart, gold began to test the support floor at 2900 during the previous American session, recording a low of $2880 per ounce. Simple moving averages are now …

Read More »Euro tries to build on support 11/3/2025

In the previous trading session, the euro traded in a narrow range as it worked to sustain its upward trend. On the 4‑hour chart, the pair remains supported above its 50‑day simple moving average, which is contributing to the current bullish momentum. The euro is also showing efforts to establish …

Read More »Dow Jones Awaits US Jobs 7/3/2025

Oil, Crude, trading

Read More »CAD gradually loses upward momentum 7/3/2025

The Canadian dollar continues its gradual upward movement, following the expected bullish path from Negative pressure dominated the Canadian dollar’s movement during the previous session. The recent price action—marked by a low of 1.4240—suggests that a break below the support level of 1.4410 could trigger further downside, with a target …

Read More »GBP looks for additional momentum 7/3/2025

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations