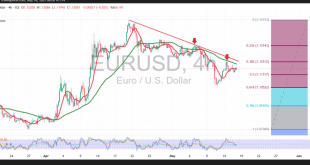

The EUR/USD pair traded within a narrow sideways range during the previous session, with limited attempts to generate short-term gains amid subdued momentum. From a technical perspective, the 4-hour (240-minute) chart shows the pair continuing to trade below the 50-period simple moving average, which is acting as a firm resistance …

Read More »Dow Jones struggles to hold above Key support 15/5/2025

Oil, Crude, trading

Read More »CAD starts positively 15/5/2025

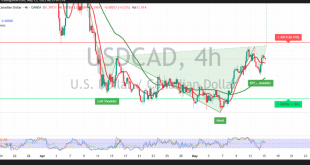

The Canadian dollar has resumed an upward corrective trend after establishing a solid support base around the psychological level of 1.3900. From a technical standpoint, the 4-hour chart indicates that bullish momentum is gaining traction. The pair is now supported by upward-sloping simple moving averages, which are once again acting …

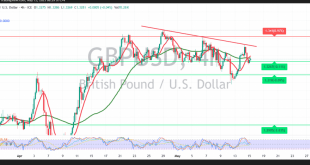

Read More »GBP to break support 15/5/2025

Oil, Crude, trading

Read More »Oil hovers near support, Eyes potential rebound 15/5/2025

U.S. crude oil futures are currently trading with a bearish tone, following a retreat from the recent high of $63.64 per barrel recorded in the previous session. Technically, the price is attempting to stabilize near the key support level at $61.20, suggesting the possibility of a short-term rebound. This potential …

Read More »Gold breaks through uptrend support line 15/5/2025

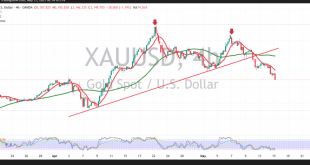

Gold prices declined sharply in the previous session, pressured by profit-taking after strong gains earlier in the year. The market reached key downside targets outlined in the previous report, with prices falling to a low of $3,148 during early trading today. From a technical perspective, the 4-hour chart reveals a …

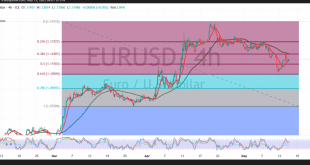

Read More »Euro weakens as Dollar gains ground 15/5/2025

The euro is facing renewed intraday selling pressure as the U.S. dollar attempts to stage a modest rebound. From a technical standpoint, the 4-hour (240-minute) chart shows the pair trading below the 50-period simple moving average, which is acting as strong resistance near the 1.1250 level. Additionally, the Relative Strength …

Read More »Weekly market recap: China dictates market directions

US dollar managed to grasp confidence of investors gradually after positive developments of a potential trade deal between Washington and Beijing throughout last trading week. The possibility to de-escalate trade war between USA and China after increased US president Donald Trump said that the huge tariffs on China could be …

Read More »Dow Jones tries to hold above support 16/4/2025

Oil, Crude, trading

Read More »CAD is trending down, all eyes on BoC 16/4/2025

The Canadian dollar remains under sustained downward pressure, with the pair extending its losses over several consecutive sessions and reaching a recent low of 1.3828. From a technical standpoint, the 4-hour chart confirms the continuation of the dominant downtrend. Price action remains firmly below the key simple moving averages, which …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations