Gold prices have fallen by 0.90% in the mid-North American session on Tuesday, amid risk-off sentiment and falling US Treasury bond yields. The latest tranche of US economic data shows the economy is slowing down, warranting lower interest rates. However, the Gold Index, XAU/USD, trades with losses and exchanges hands …

Read More »Oil Prices Soar Amid U.S.-Iran Tensions – 2026 Outlook Brightens

Crude Oil Surges as Geopolitical Tensions Heat UpGlobal oil prices surged sharply this week as tensi…

Wall Street Stumbles as Global Tensions Bite, Inflation Clouds the Outlook

Wall Street opened today under a heavy cloud of renewed inflation worries. Fresh data showed that pr…

SpaceX ETF Hits Turbulence as Private Stock Stakes Balloon, A Private Giant in Public Hands

The SpaceX ETF is under the spotlight as its stake in the private space company has soared to nearly…

Behind the AI Race Scene: Is Apple Playing a Different Game?

In the high‑stakes world of artificial intelligence, the headlines are dominated by tech giants raci…

Gold Surges Past $5,200 Amid US-Iran Tensions

Gold reclaimed the $5,200 level on Friday, driven by heightened geopolitical risks and a surge in sa…

Dollar Fails to Shine as Inflation Heats Up, Euro Holds Its Ground, Yen Finds Footing

The U.S. dollar is showing signs of hesitation despite recent inflation data that many had expected …

Inflation Heats Up Again: Rising Producer Prices Shake Markets, Bitcoin Slips

Fresh U.S. inflation data has stirred markets, showing that price pressures are still lingering in t…

Germany’s Inflation Cools to 1.9% in February, Easing Pressure on the Euro

Germany’s annual inflation slowed to 1.9% in February, down from 2.1% in January, signaling a modest…

Oil Jumps as Iran Nuclear Talks Stall, Reviving Fears of Middle East Supply Disruptions

Oil prices climbed sharply on Friday after negotiations between the United States and Iran over Tehr…

Wall Street Futures Slide as Nvidia Pullback and Inflation Jitters Darken Week’s End

U.S. stock index futures fell on Friday, signaling a cautious close to the week as renewed pressure …

Market Analysis

June, 2024

-

4 June 2024 10:25 pm

Growing on-chain activity to push BNB to all time highs

Binance Coin (BNB) is on the verge of a potential breakout to a new all-time high, driven by growing on-chain activity, a recent price surge, and the resolution of ex-CEO Changpeng Zhao’s legal issues. The token has been trading within an ascending triangle pattern since May 16, with a bullish …

Read More » -

4 June 2024 9:03 pm

US dollar struggles amid weak labour market data

Following steep losses on Monday as a result of the unsatisfactory May ISM PMIs, the US dollar secured some gains although JOLTS for April revealed fewer job openings than anticipated. Despite struggling, the US Dollar Index is 0.04% up, trading at 104.09 at the time of writing. In order to …

Read More » -

4 June 2024 8:23 pm

US stocks retreat on weaker economy woes

Investors reacted to underwhelming recent economic data and prepared for the release of key payroll data later this week.Monday’s US manufacturing data for May came in below expectations and indicated that a recent contraction is deepening, albeit slightly.These figures follow other data that suggests the world’s largest economy is slowing …

Read More » -

4 June 2024 7:45 pm

Rumours drag USD/JPY lower

USD/JPY has fallen to 155.00 due to a combination of risk-off market sentiment and rumors that the Bank of Japan (BoJ) is considering reducing bond purchases at its June meeting. This move would raise Japanese bond yields and support the Yen, a negative for USD/JPY. The US Dollar (USD) bounced …

Read More » -

4 June 2024 6:52 pm

ChatGPT down again after “major outage”

After what OpenAI referred to as a “major outage” earlier today that affected millions of users globally, ChatGPT seems to have recovered. But it appears that the chatbot is having problems once more, as OpenAI reports that it is “unavailable for some users” once more. Reports of today’s ChatGPT issues …

Read More » -

4 June 2024 6:10 pm

US JOLTS Job Openings decline below expectations

The number of job openings on the last business day of April stood at 8.059 million, the US Bureau of Labor Statistics (BLS) reported in the Job Openings and Labor Turnover Survey (JOLTS) on Tuesday. This reading followed the 8.35 million (revised from 8.48 million) openings reported in March and …

Read More » -

4 June 2024 1:43 pm

Dollar Recovers After Steep Losses, Euro Dips on Weak German Employment Data

The U.S. dollar rebounded in early European trading on Tuesday, reversing overnight declines. The euro weakened following the release of disappointing German employment figures. At 04:45 ET (08:45 GMT), the Dollar Index, which measures the greenback against a basket of six other currencies, rose 0.1% to 104.165, after briefly falling …

Read More » -

4 June 2024 12:43 pm

European Stocks Retreat Amid ECB Caution and US Labor Market Data Anticipation

European stock markets experienced a downturn on Tuesday, driven by investor caution ahead of the European Central Bank’s (ECB) upcoming policy meeting later in the week. As of 03:20 ET (07:20 GMT), the DAX index in Germany declined by 0.6%, the CAC 40 in France fell by the same margin, …

Read More » -

4 June 2024 11:48 am

Asian Markets Dip on India Election Results and U.S. Economic Concerns

Asian share markets experienced a downturn on Tuesday as global investors awaited the official results of India’s general election and assessed the potential weakening of the U.S. economy’s exceptionalism amid further decline in manufacturing activity. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.4%, despite mild gains in U.S. …

Read More » -

4 June 2024 5:41 am

Market Drivers; US Session, June 3

The New York Stock Exchange said Monday that a technical issue that halted trading for some major stocks and caused Berkshire Hathaway to be down 99.97% has been resolved. In an update, NYSE said impacted stocks have reopened and “all systems are currently operational.” Inter-continental Exchange, the parent company of …

Read More » -

4 June 2024 4:30 am

Japan’s Suzuki: Early May intervention was in a response to speculations

Japanese Finance Minister Shunichi Suzuki said on Tuesday that foreign exchange (FX) intervention had effects to some effects, adding that the central bank will continue to respond appropriately when asked about forex. At the time of writing, USD/JPY is 0.19% higher on the day trading at 156.38. the USD/JPY pair …

Read More » -

4 June 2024 3:16 am

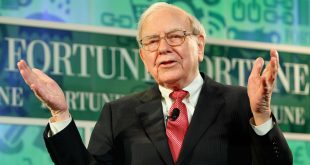

Why have some of Warren Buffett’s shares dropped by 100%?

On the opening day of the new trading week, there were trading disruptions on the New York Stock Exchange due to a technical issue that resulted in the suspension of trading in certain blue-chip companies and large losses for other equities during Monday’s session.The most severely impacted company by this …

Read More »

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations