Chancellor Angela Merkel pressed German states today, Sunday, to intensify efforts to curb the increasing number of infections with the Coronavirus, and raised the possibility of a curfew in an attempt to control the third wave. “We have our emergency brakes … unfortunately they are not respected everywhere. I hope …

Read More »Bitcoin Slides to Six-Month Low, Erasing Half Its Value as Tariff Uncertainty Fuels Risk Aversion

Bitcoin fell sharply on Tuesday, extending its recent downturn and wiping out roughly half of its va…

U.S. Customs Halts Collection of Trump’s Emergency Tariffs After Supreme Court Ruling

U.S. Customs and Border Protection (CBP) said it will stop collecting tariffs imposed under the Inte…

Gold Pulls Back as Profit-Taking and Stronger Dollar Halt Bullion Rally

Gold prices eased on Tuesday as investors locked in profits after the precious metal surged more tha…

Dow Plunges Over 800 Points as Tariff Jitters and AI Disruption Concerns Rattle Markets

Wall Street Slides as Trump Tariff Uncertainty and AI Fears Jolt Markets; Gold and Volatility Surge …

US Session Key Drivers – Dollar Steadies After a Political Shock

Global markets opened the week in a cautious mood as investors absorbed the fallout from a major leg…

Bitcoin Advances Near $ 65,000 as Global Uncertainty Reshapes Risk Appetite

Bitcoin is heading up +0.51% hovering around $65,000 after entering the new week on the defensive, e…

Oil Prices Caught in the Crosscurrents of Politics and Demand

The energy market is catching its breath. Crude oil prices are no longer racing ahead, but they are …

After the Court Ruling, How is Trump Redrawing the Tariff Map

A recent decision by the Supreme Court has disrupted a central pillar of the current U.S. trade stra…

ECB Signals Steady Course as Europe Eyes Growth Through AI Adoption

The European Central Bank has signaled continuity rather than change, reinforcing the view that mone…

USD/CAD Steadies as Dollar Weakness Meets Falling Oil Prices

The USD/CAD currency pair traded around 1.3665 on Monday, showing relative stability at the start of…

Market Analysis

March, 2021

-

29 March 2021 11:11 am

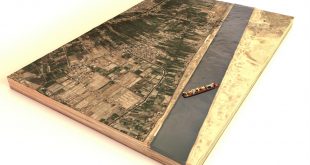

Oil Decline as The Stuck Ship Ship Begins Moving in the Suez Canal

Oil fell by more than 2% on Monday, March 29th, after news from the Suez Canal that rescue crews managed to move the giant container ship that has been blocking the vital global trade corridor for nearly a week. Brent crude fell $1.38, equivalent to 2.1%, to $63.19 a barrel. …

Read More » -

29 March 2021 10:46 am

Successful Floatation of The Panamanian Container Vessel EverGiven

Lieutenant-General Osama Rabie, Chairman of the Suez Canal Authority, announced that the Panamanian container ship Ever Given had successfully floated after the ship responded to the tension and towing maneuvers, whereby the ship’s course was significantly modified by 80% and the stern of the ship moved away from the shore …

Read More » -

27 March 2021 2:14 am

Wall Street Close Friday with Large Gains

The New York Stock Exchange (NYSE) finished Friday with large gains, supported by the rise of many sectors led by tech, healthcare, and financial services, amid positive expectations for economic recovery that reflected positively on Wall Street. The Dow Jones Industrial Average gained 453.4 points, or 1.39%, to close at …

Read More » -

27 March 2021 1:50 am

Oil Narrows Most Weekly Losses as Supply Disruptions Balance Demand Concerns

Oil futures rose on Friday, as a stranded ship continues to block the Suez Canal, one of the world’s major trade routes, thus disrupting the flow of large crude supplies. However, crude prices finished the week in losses, amid concerns about the resurgence of the Coronavirus pandemic through a third …

Read More » -

27 March 2021 1:12 am

Gold Rises but Settles with Weekly Losses

Gold prices rose on Friday, despite the stability shown by the U.S. Dollar (USD), amid increased demand from investors for safe havens. However, the yellow metal was unable to recover its weekly losses, most of which resulted from the rise of the USD and the high Treasury bond yields. Gold …

Read More » -

27 March 2021 12:22 am

USD Steadies Near Highest Level in Four Months

The U.S. Dollar (USD) maintained some of its gains on Friday, despite the rise of the Euro and the Sterling Pound, supported by positive expectations for economic recovery in the United States. Large gains against the Japanese Yen (JPY) and the Australian Dollar (AUD) balanced off losses against the Euro …

Read More » -

27 March 2021 12:13 am

U.S. Oil Rigs Rise by Six in Week

The number of active rigs drilling for crude oil and natural gas in the United States increased by six this week to 417, data by Baker Hughes showed on Friday. The rig count is now lower by 311 rigs compared with the same time of last year. It is worth …

Read More » -

26 March 2021 9:58 pm

European Stocks Close Higher Supported by Mining and Tech Gains

European stocks finished Friday higher, supported by an improved investors’ sentiment amid positive expectations for the distribution of vaccines and recovering economies. The pan-European index STOXX 600 gained 0.91% and finished at 426.95 points, nearing its all-time high as it ended the week in gains for the fourth consecutive week, …

Read More » -

26 March 2021 7:51 pm

UK and EU Reach Initial Agreement to Cooperate in Market Regulation

The United Kingdom (UK) and the European Union (EU) are said to have reached an agreement to coordinate financial markets regulation following the Brexit, Bloomberg reported. The agreed upon Memorandum of Understanding (MoU) has been finalized and is pending the official procedures of approval and ratification. The agreement identifies the …

Read More » -

26 March 2021 7:28 pm

U.S. Consumer Sentiment Improves in March

Consumer sentiment in the United States continued to rise in March, reaching its highest level in a year, data by the University of Michigan showed on Friday. The Index of Consumer Sentiment improved by 10.5% to 84.9 in March, from 76.8 in February. However, it declined on an annual basis …

Read More » -

26 March 2021 5:12 pm

US: Annual Core PCE Price Index Edges Lower in February

The Personal Consumption Expenditures (PCE) Price Index in February edged lower to 0.2% on a monthly basis and came in lower than the market expectation of 0.5%, the data published by the US Bureau of Economic Analysis showed on Friday. On a yearly basis, the PCE Price Index rose to …

Read More » -

26 March 2021 5:06 pm

US: Personal Income Falls by 7.1% in February, Personal Spending Drops

The US Bureau of Economic Analysis reported on Friday that Personal Income in February declined 7.1% on a monthly basis. This reading followed January’s impressive increase of 10.1% and came in slightly better than the market expectation for a decrease of 7.3%. Further details of the publication showed that Personal …

Read More »

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations